L'explication de l'automatisation des contrats : comment améliorer l'expérience client et assurer la conformité avec l'intégration numérique des clients

Les institutions financières (IMF) du monde entier signent, gèrent et concluent des accords avec leurs clients des millions de fois par jour. Les accords sont au cœur même de toutes les entreprises et essentiels pour générer des revenus. Qu'il s'en soit de prêts et de baux, d'hypothèques ou d'assurance, chaque relation client commence par une nouvelle entente.

Qu'est-ce que l'automatisation des accords?

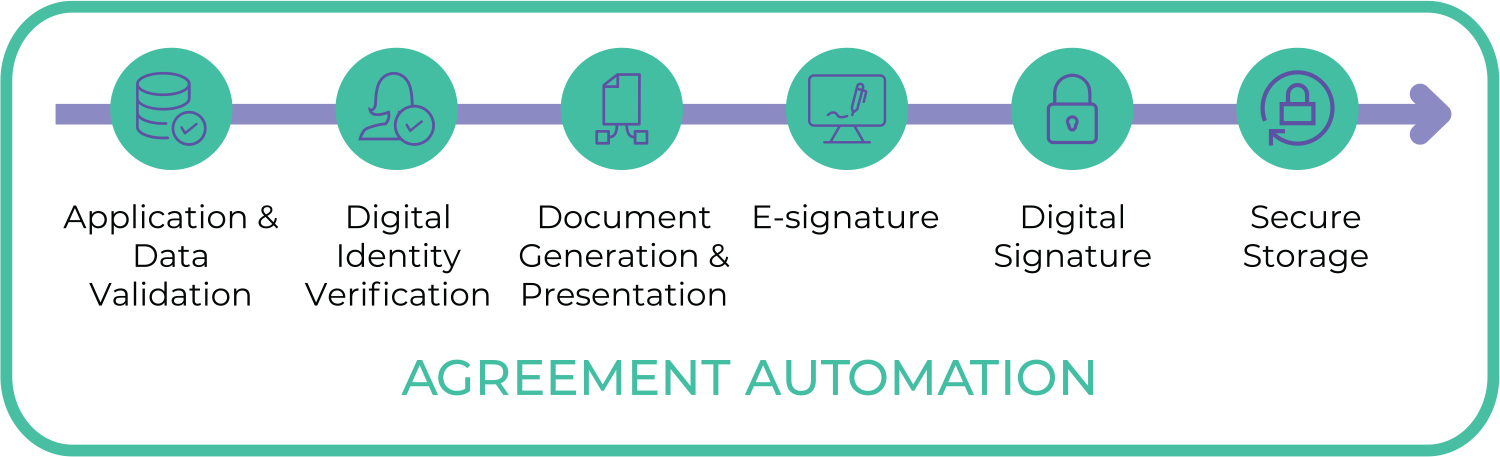

L'automatisation des ententes est la numérisation du parcours client pour les accords financiers — du client qui présente une demande, en passant par la vérification d'identité numérique, la livraison électronique, la présentation, la signature d'un accord et la capture et la gestion de toutes les pistes d'audit à l'appui. L'automatisation des accords fait partie de l'intégration des clients numériques.

Alors que les IMF cherchent à poursuivre leurs investissements dans la transformation numérique en numérisant les processus de front-office qui ont un impact direct sur l'expérience client (comme l'intégration des clients), l'analyse de rentabilisation des logiciels d'automatisation des accords est claire. En numérisant les processus d'accord client, les IF peuvent offrir une expérience utilisateur numérique rapide, cohérente, tout en aidant à se protéger contre la fraude.

Pourquoi l'automatisation des accords est utilisée par les institutions financières

Lorsqu'un client décide d'ouvrir un nouveau compte, de souschausser un nouveau prêt, de signer un contrat de location ou de s'inscrire à un certain nombre de nouveaux produits financiers, il conclu un accord financier avec une institution financière. L'entente financière définit les niveaux de service et les modalités qui doivent être convenus par les deux parties pour que l'entente soit conclue et que le produit ou le service soit livré.

À l'heure actuelle, de nombreux clients transigéront avec des IMF en personne, dans une succursale ou par l'intermédiaire d'un intermédiaire à l'aide de documents papier et de vérifications d'identité manuelles.

Dans le monde numérique d'aujourd'hui, les institutions financières doivent offrir à leurs clients une expérience client entièrement numérique et sécurisée, afin que les utilisateurs puissent accéder rapidement et facilement aux produits et services. Cela signifie que le nouveau processus d'ouverture de compte du client doit être numérisé et automatisé.

Comment l'automatisation des accords prend en charge l'intégration numérique

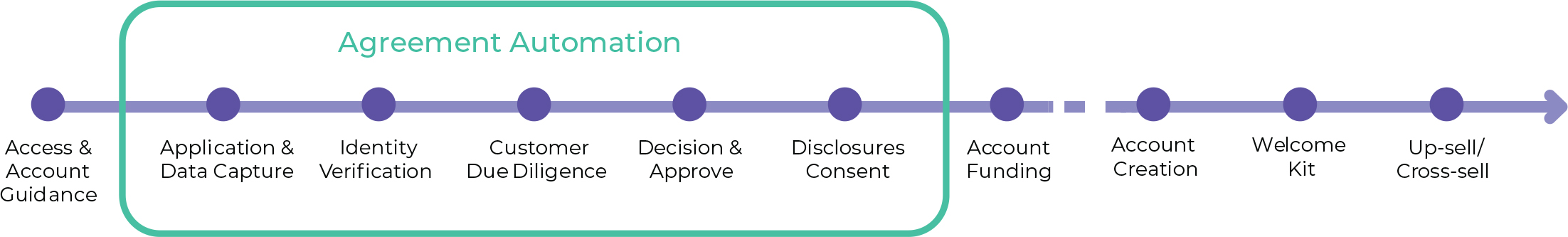

L'automatisation des accords n'est qu'un aspect de l'ensemble du parcours d'intégration du client, qui comprend l'acquisition de clients, l'ouverturede compte et l'intégration des clients. Le diagramme ci-dessous montre où l'automatisation de l'accord s'inscrit dans le parcours global du client.

Les institutions financières qui cherchent à automatiser l'ensemble du voyage d'intégration du client devraient chercher des solutions qui sont en mesure de s'intégrer ensemble pour offrir un voyage numérique positif pour le client.

Avantages d'automatisation des accords pour les institutions financières

Les institutions financières automatisent leurs processus d'entente pour trois raisons clés :

1. Améliorer l'expérience client, réduire l'abandon et augmenter la conversion

En accélérant le processus d'entente client et en éliminant les principaux points de frustration pour le client, tels que les formulaires papier et la vérification d'identité en personne, les IF peuvent améliorer considérablement l'expérience client. L'automatisation des accords comprend la vérification d'identité numérique et les signatures électroniques, qui permettent aux IMF de supprimer les formulaires papier et la vérification d'identité en personne. Cette amélioration du flux de travail entraîne des taux de conversion plus élevés et, en fin de compte, une augmentation des revenus.

La numérisation offre également une expérience client cohérente sur tous les canaux et permet aux clients de compléter le processus sur leur propre appareil et en leur temps.

Des recherches du Groupe Aite ont révélé que les taux d'abandon pour les processus d'ouverture de comptes financiers se siant entre 65 et 95%, selon le produit. En supprimant les étapes manuelles et papier et en mettant en œuvre des processus mobiles d'abord, tels que la capture de données mobiles et la vérification d'identité numérique, les IF peuvent réduire l'abandon des clients, ce qui entraîne une augmentation de la croissance de la première ligne.

Pour une société de financement automobile, l'automatisation des accords leur a permis d'augmenter rapidement leur chiffre d'affaires à plus de 150 millions d'euros (200 millions d'euros) de nouvelles activités par mois, sans ajouter d'effectifs supplémentaires.

2. Améliorer l'efficacité

L'automatisation des accords entraîne de multiples gains d'efficacité opérationnelle par rapport aux solutions de rechange manuelles et sur papier. En automatisant entièrement le processus d'accord client et en supprimant les formulaires papier et les signatures humides, la consommation de papier est considérablement réduite. La suppression des étapes manuelles réduit également les coûts des IF, ce qui leur permet de réduire le coût de croissance. Une banque américaine qui a numérisé les prêts à la consommation et les prêts aux PME, a éliminé 80 % des coûts de traitement des documents grâce à des processus d'entente automatisés,ce qui représente des millions de dollars économisés.

L'automatisation du processus d'accord entraîne également une réduction du temps de traitement des demandes en raison de la suppression des étapes manuelles, telles que la nécessité d'examiner manuellement les demandes d'erreurs. Assurer des demandes de prêt sans erreur peut grandement améliorer les performances. Pour la usBank, cela signifiait que les banquiers n'avaient plus besoin de traiter et de traiter manuellement les documents, ce qui les libérait pour passer plus de temps à vendre plus de prêts et à servir les clients.

3. Réduire les risques et atteindre la conformité

L'un des plus grands défis de numérisation auxquels les IMF sont confrontés est la nécessité d'équilibrer l'amélioration de l'expérience client (CX) avec les considérations de sécurité. L'automatisation des accords n'oblige pas les IMF à faire un compromis CX/sécurité : elle offre à la fois une expérience numérique sans friction tout en fournissant les garanties de sécurité nécessaires contre les risques.

L'automatisation des accords peut également réduire les risques, car elle permet aux FI de contrôler le flux de travail du début à la fin, ce qui signifie que le processus est effectué de manière conforme. La numérisation du processus d'entente permet aux institutions financières de saisir des preuves électroniques inviolables tout au long du processus sous la forme de pistes de vérification numérique. Les pistes de vérification numérique peuvent inclure des preuves de conformité, des preuves de l'identité du client ou des preuves de son intention d'être lié par l'entente. Si elles sont stockées dans un ensemble inviolable, la preuve peut aider à prouver que les ententes qui en résultent sont légales, conformes et exécutoires si elles sont contestées. Pour la Banque de Montréal (BMO), l'automatisation a permis à la banque d'atteindre un ratio d'efficacité de 80 % dans la fonction de piste de vérification de la banque.

L'automatisation des accords peut également aider les IMF à répondre aux exigences nécessaires de Know Your Customer (KYC). Pour se conformer à la réglementation anti-blanchiment, les organismes de réglementation exigent des IMF qu'ils vérifient l'identité des clients potentiels. Les processus KYC aident les FI à prouver que le client est ce qu'ils disent être, et que la FI peut légalement faire affaire avec eux.

La vérification KYC peut être effectuée numériquement en faisant correspondre les données d'application vérifiées (comme le nom, l'adresse, la date de naissance) à des sources de données fiables telles que les listes d'électeurs et les bureaux d'identité. La vérification KYC peut atténuer le risque de fraude de demande de premier parti, de tiers et de personnel en examinant les détails des demandeurs par rapport aux données négatives afin d'identifier la fraude et les activités de LAM. La géolocalisation IP, la vérification des périphériques et les vérifications d'entreprise contribuent également à établir un profil de vérification solide pour un demandeur. L'identité d'un candidat inconnu peut être vérifiée numériquement à l'aide d'une méthode de vérification numérique de l'identité, comme la vérification des documents d'identité.

Les meilleures pratiques d'automatisation des accords pour les institutions financières

-

Supprimer la friction des formulaires papier - Les étapes manuelles, telles que les formulaires papier, ralentissent le nouveau processus d'ouverture de compte et frustrent les clients. Le demandeur d'aujourd'hui est à la recherche de vitesse, de facilité et de commodité. Les formulaires papier causent des frictions et augmentent le risque d'abandon des clients.

- Éliminer l'entrée manuelle des données et les vérifications d'application - Les formulaires papier nécessitent qu'un FI entre manuellement les données des clients dans une application. Ce processus augmente le risque d'erreur humaine. Les vérifications manuelles et le processus de re-keying des applications en raison d'une erreur humaine augmente considérablement les coûts d'acquisition. En numérisant l'étape de capture des informations clients, les étapes manuelles sont supprimées et les coûts d'acquisition sont réduits.

- Numériser la vérification d'identité - Exiger des candidats qu'ils apportent des documents d'identité physiques dans la succursale locale d'un FI provoque des frictions et de la frustration chez les clients. La vérification d'identité numérique donne aux institutions financières la possibilité de prouver rapidement et de façon conforme l'identité d'un demandeur, réduisant ainsi les frictions et la frustration lors de l'ouverture d'un nouveau compte.

- Réduire la fraude aux demandes - Selon une étude d'Aite Group, la fraude aux applications est la #2 cause de perte de fraude pour les IF après la prise de compte de la fraude. La lutte contre la fraude aux applications est donc une bataille ardue pour les institutions financières. À mesure que la fraude de première partie continue de croître, il est de plus en plus important que les IMF déterminent et prouvent avec qui elles transiculent. La vérification d'identité numérique permet aux FI de prouver qui est leur demandeur et qu'elles sont véritablement la personne avec qui le FI est en transaction. Les recherches d'Aite Group indiquent que 90 % des IMF indiquent des plans visant à mettre en œuvre des solutions mobiles de capture et de vérification de documents d'identité au cours des deux prochaines années.

- Capture Customers Intent - E-Signatures have the same legal status as handwritten ink signatures in the United States (ESIGN Act - UETA), Canada (UECA), the European Union (eIDAS), Australia (Electronic Transfers Act), China (Law of the People's Republic of China on Electronic Signature), Brazil (Provisional Measure No 2200-2 of 2001), Japan (Law Concerning Electronic Signatures and Certification Services), and many other countries. Lors de la numérisation de l'ensemble du processus d'accord, l'élément de signature est souvent vécu par le client comme "cliquez ici pour signer".

- Secure Digital Audit Trails - Les FI devraient saisir les pistes de vérification numérique pour prouver que des pratiques justes et conformes ont été suivies, que l'identité du demandeur a été vérifiée et que les demandeurs étaient pleinement au courant de ce pour quoi ils s'inscrivaient au moment de la signature d'une entente. Les pistes d'audit numérique aident également les IMF à prouver la conformité et à éviter les défaillances de conformité et les amendes financières potentielles.

- Solution à l'épreuve de l'avenir - Le changement est une partie inévitable de l'industrie des services financiers. S'adapter au changement nécessite des processus et une technologie qui peuvent être facilement mis à jour. Si les technologies ne peuvent pas être mises à jour, les processus d'accord financier risquent de devenir non conformes, obsolètes ou coûteux sur le plan opérationnel.

Les FI devraient également s'assurer qu'elles ne dépendent pas d'un seul fournisseur de vérification d'identité numérique ou d'une méthode de vérification, et qu'elles ont accès à de nouvelles méthodes de vérification d'identité numérique lorsqu'elles arrivent sur le marché. L'accès à de multiples méthodes de vérification d'identité permet aux IMF de s'adapter aux changements technologiques et aux attentes des consommateurs et contribue à réduire les nouveaux taux d'abandon des applications.