Results Q2 2010

Revenue for the second quarter 2010 was $24.7 million, an increase of 1% compared to the second quarter 2009; Operating income for the second quarter 2010 was $1.6 million, an increase of 17% compared to the second quarter 2009. Guidance for full-year revenue growth in 2010 over 2009 is being reduced. Financial results for the period ended June 30, 2010 and guidance for full-year 2010 will be discussed on conference call today at 10:00 a.m. E.D.T.

OAKBROOK TERRACE, IL, and ZURICH, Switzerland, July 27, 2010 - VASCO Data Security International, Inc. (Nasdaq: VDSI) (www.vasco.com), today reported financial results for the second quarter and six months ended June 30, 2010.

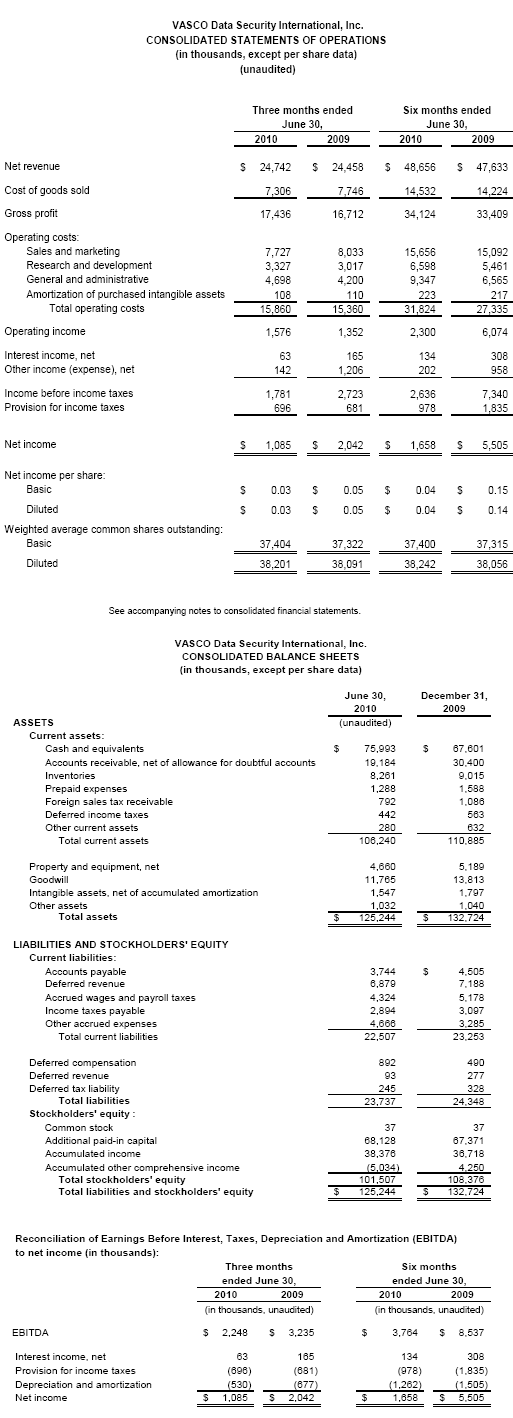

Revenue for the second quarter of 2010 increased 1% to $24.7 million from $24.5 million in the second quarter of 2009, and for the first six months of 2010, increased 2% to $48.7 million from $47.6 million for the first six months of 2009.

Net income for the second quarter of 2010 was $1.1 million, or $0.03 per diluted share, a decrease of $0.9 million, or 47%, from $2.0 million, or $0.05 per diluted share, for the second quarter of 2009. Net income for the first six months of 2010 was $1.7 million, or $0.04 per diluted share, a decrease of $3.8 million, or 70%, from $5.5 million, or $0.14 per diluted share, for the comparable period in 2009.

- Gross profit was $17.4 million, or 70% of revenue, for the second quarter of 2010 and $34.1 million, or 70% of revenue, for the first six months of 2010. Gross profit was $16.7 million or 68% of revenue for the second quarter of 2009 and $33.4 million, or 70% of revenue, for the first six months of 2009.

- Operating expenses for the second quarter and first six months of 2010 were $15.9 million and $31.8 million, respectively, an increase of 3% from $15.4 million reported for the second quarter of 2009 and an increase of 16% from $27.3 million reported for the first six months of 2009.

Operating expenses for the second quarter and first six months of 2010 included $0.6 million and $1.2 million, respectively, of expenses related to stock-based incentives. Operating expenses for the second quarter of 2009 included $0.4 million of expenses related to stock-based incentives. For the first six months of 2009, operating expenses reflected a benefit of $1.3 million related to stock-based incentives, including the reversal in the first quarter of 2009 of $2.0 million of long-term performance-based incentive award reserves that had been accrued at December 31, 2008.

- Operating income for the second quarter and first six months of 2010 was $1.6 million and $2.3 million, respectively, an increase of $0.2 million, or 17%, from $1.4 million reported for the second quarter of 2009 and a decrease of $3.8 million, or 62%, from $6.1 million reported for the first six months of 2009. Operating income, as a percentage of revenue, for the second quarter and first six months of 2010 was 6% and 5%, respectively, compared to 6% and 13% for the comparable periods in 2009.

- Earnings before interest, taxes, depreciation and amortization (EBITDA) was $2.2 million and $3.8 million for the second quarter and first six months of 2010, respectively, a decrease of 31% from $3.2 million reported for the second quarter of 2009 and a decrease of 56% from $8.5 million reported for the first six months of 2009.

- Net cash balances, cash balances less borrowing under VASCO’s line of credit, at June 30, 2010 totaled $76.0 million compared to $76.1 million and $67.6 million at March 31, 2010 and December 31, 2009, respectively.

- VASCO won 480 new customers in Q2 2010 (56 new banks and 424 new enterprise security customers). For the first six months of 2010, VASCO won 918 new customers (108 banks and 810 enterprise security customers). Although management considers the number of new customers as an indicator of the momentum of our business and effectiveness of our distribution channel, the number of new customers is not indicative of future revenue.

- VASCO enhances its presence in the Australian and New Zealand market by partnering with Westcon Group.

- The Ohio Housing Finance Agency (OHFA) chooses VASCO’s DIGIPASS for Web to secure its Lender Online application.

- VASCO announces a secure solution for document viewing. VASCO has incorporated its VACMAN Controller authentication technology with Adobe® LiveCycle® Rights Management Enterprise Suite 2 (ES2), offering a secure solution for documents that need to be accessed over the Internet.

- VASCO announces new members of the DIGIPASS Pack family: DIGIPASS Pack for Remote Authentication Gold and Platinum Edition, which are based on IDENTIKEY® Server software, VASCO’s comprehensive authentication server, with DIGIPASS® GO6 authenticators. Both packs are total solutions for strong user authentication in a box.

- VASCO launches DIGIPASS for Windows. DIGIPASS for Windows adds strong authentication to secure networks and applications without using hardware-based devices or mobile phones as client authentication platforms.

- VASCO launches IDENTIKEY Server Banking Edition; IDENTIKEY supports EMV-CAP based and Hardware Security Module (HSM) based authentication.

- VASCO launches DIGIPASS Pack for Remote Authentication including DIGIPASS for Mobile. The new packs include DIGIPASS for Mobile licenses, enabling the use of a mobile phone as an authentication device.

- VASCO’s aXsGUARD Gatekeeper offers PKI and SSL-VPN client support.

VASCO is revising its guidance for the full-year 2010 as follows:

- Revenue growth of 5% to 10% for the full-year 2010 over full-year 2009, down from 15% to 20% announced at the end of the first quarter of 2010, and

- Operating margin as a percentage of revenue for full-year 2010 is projected to be in the range of 5% to 10%, no change from guidance previously announced.

“While discussions with customers, both existing and new, regarding potential new projects remained strong, the number of units shipped in the second quarter of 2010 fell short of our expectations,” stated T. Kendall Hunt, Chairman & CEO. “The shortfall was primarily in the European banking market where the recovery is progressing more slowly than we had expected. Revenue growth in the second quarter from banking markets outside of Europe, as well as the growth in our enterprise security business, however, continued to meet our expectations. We also made good progress in the development of new products and in the preparation for the launch of our authentication services product line.”

"Based on both the number and size of new projects being discussed, as well as the number of proposals we have tentatively won pending the completion of purchase agreements, we remain confident that growth will return in the banking market and we expect to see an increase in deliveries in late 2010 or early 2011," said Jan Valcke, VASCO's President and COO. "We continue to invest aggressively in new people, products and the infrastructure needed to support our anticipated future growth."

Cliff Bown, Executive Vice President and CFO added, “During the second quarter of 2010 our balance sheet continued to show strength. Despite the weakening of the Euro against the U.S. Dollar, our net cash and working capital balances remained relatively constant as compared with our balances at the end of the first quarter. At the end of the second quarter, our net cash balance was $76.0 million and compares to $76.1 million and $67.6 million at March 31, 2010 and December 31, 2009, respectively. Our working capital at June 30, 2010 was $83.7 million and compares to $86.3 million and $87.6 million at March 31, 2010 and December 31, 2009, respectively. Days sales outstanding in net accounts receivable at June 30, 2010 decreased to 71 days from 83 days at March 31, 2010.

In conjunction with this announcement, VASCO Data Security International, Inc. will host a conference call today, July 27, 2010, at 10:00 a.m. EDT - 16:00h CET. During the conference call, Mr. Ken Hunt, CEO, Mr. Jan Valcke, President and COO, and Mr. Cliff Bown, CFO, will discuss VASCO’s results for the second quarter and first six months ended June 30, 2010.

To participate in this conference call, please dial one of the following numbers:

USA/Canada: +1 800-747-0367

International: +1 212-231-2937

And mention VASCO to be connected to the conference call.

The conference call is also available in listen-only mode on www.vasco.com. Please log on 15 minutes before the start of the conference call in order to download and install any necessary software. The recorded version of the conference call will be available on the VASCO website 24 hours a day for approximately 60 days after the call.

EBITDA is a non-GAAP financial measure within the meaning of applicable U.S. Securities and Exchange Commission rules and regulations. We use EBITDA as a measure of performance, a simplified tool for use in communicating our performance to investors and analysts and for comparisons to other companies within our industry. As a performance measure, we believe that EBITDA presents a view of our operating results that is most closely related to serving our customers. By excluding interest, taxes, depreciation and amortization we are able to evaluate performance without considering decisions that, in most cases, are not directly related to meeting our customers’ requirements and were either made in prior periods (e.g., depreciation and amortization), or deal with the structure or financing of the business (e.g., interest) or reflect the application of regulations that are outside of the control of our management team (e.g., taxes). Similarly, we find that the comparison of our results to those of our competitors is facilitated when we do not need to consider the impact of those items on our competitors’ results.

EBITDA should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States. While we believe that EBITDA, as defined above, is useful within the context described above, it is in fact incomplete and not a measure that should be used to evaluate our full performance or our prospects. Such an evaluation needs to consider all of the complexities associated with our business including, but not limited to, how past actions are affecting current results and how they may affect future results, how we have chosen to finance the business and how regulations and the other aforementioned items affect the final amounts that are or will be available to shareholders as a return on their investment. Net income determined in accordance with U.S. GAAP is the most complete measure available today to evaluate all elements of our performance. Similarly, our Consolidated Statement of Cash Flows, which will be filed as part of our annual report on Form 10-K, provides the full accounting for how we have decided to use resources provided to us from our customers, lenders and shareholders.

VASCO is a leading supplier of strong authentication and e-signature solutions and services specializing in Internet security applications and transactions. VASCO has positioned itself as global software company for Internet security serving a customer base of approximately 10,000 companies in more than 100 countries, including approximately 1,500 international financial institutions. VASCO’s prime markets are the financial sector, enterprise security, e-commerce and e-government.

Forward Looking Statements:

Statements made in this news release that relate to future plans, events or performances are forward-looking statements. Any statement containing words such as “believe,” “anticipate,” “plan,” “expect,” “intend,” “mean,” “potential” and similar words, is forward-looking, and these statements involve risks and uncertainties and are based on current expectations. Consequently, actual results could differ materially from the expectations expressed in these forward-looking statements.

Reference is made to VASCO's public filings with the U.S. Securities and Exchange Commission for further information regarding VASCO and its operations.

This document may contain trademarks of VASCO Data Security International, Inc. and its subsidiaries, including VASCO, the VASCO “V” design, DIGIPASS, VACMAN, aXsGUARD and IDENTIKEY.

You may replay the webcast online.

Here's what you'll need to listen to the broadcast:

- At least a 28.8Kbps connection to the Internet.

- OR the free Windows Media Player - download here.