VASCO Reports Results for First Quarter 2013

Revenue from continuing operations for the first quarter of 2013 was $35.4 million, an increase of 10% compared to the first quarter 2012; Operating income from continuing operations for the first quarter of 2013 was $2.7 million, an increase of 23% compared to the first quarter 2012. Financial results for the period ended March 31, 2013 and guidance for full-year 2013 to be discussed on conference call today at 10:00 a.m. E.D.T.

OAKBROOK TERRACE, IL, and ZURICH, Switzerland, April 25, 2013 - VASCO Data Security International, Inc. (NASDAQ: VDSI) (www.vasco.com), today reported financial results for the first quarter ended March 31, 2013.

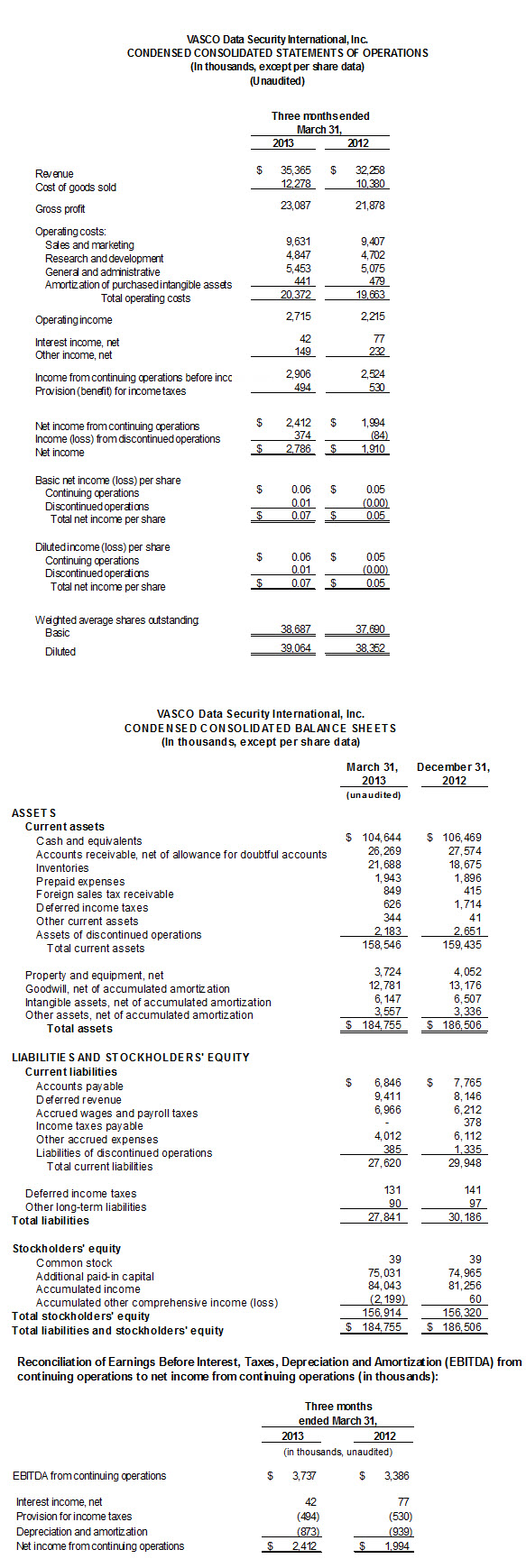

Revenue from continuing operations for the first quarter of 2013 increased 10% to $35.4 million from $32.3 million in the first quarter of 2012. Net income from continuing operations for the first quarter of 2013 was $2.4 million, or $0.06 per fully diluted share, an increase of $0.4 million, or 20%, from $2.0 million, or $0.05 per fully diluted share, for the first quarter of 2012.

Net income, which includes the impact of our discontinued operations, for the first quarter of 2013 was $2.8 million, or $0.07 per diluted share. Net income for the first quarter of 2012 was $1.9 million, or $0.05 per diluted share.

Financial Highlights:

- Gross profit from continuing operations was $23.1 million, or 65%, of revenue for the first quarter of 2013. Gross profit was $21.9 million, or 68%, of revenue for the first quarter of 2012.

- Operating expenses from continuing operations for the first quarter 2013 were $20.4 million, an increase of 4% from $19.7 million reported for the first quarter 2012. Operating expenses for the first quarter of 2012 included $1.1 million of non-cash compensation expenses and $0.5 million of amortization expense related to purchased intangible assets.

- Operating income from continuing operations for the first quarter 2013 was $2.7 million, an increase of $0.5 million, or 23%, from $2.2 million reported for the first quarter of 2012. Operating income as a percentage of revenue in the first quarter 2013 was 8% compared to 7% in the first quarter of 2012.

- Earnings before interest, taxes, depreciation and amortization from continuing operations were $3.7 million for the first quarter 2013, an increase of 9% from $3.4 million reported for the first quarter of 2012.

- Net cash balances, total cash and cash equivalents less bank borrowings, at March 31, 2013 totaled $104.6 million compared to $106.5 million at December 31, 2012. There were no bank borrowings at either March 31, 2013 or December 31, 2012.

Operational and Other Highlights:

- VASCO releases enhanced version of MYDIGIPASS.COM platform.

- VASCO awarded Golden European Seal of e-Excellence for MYDIGIPASS.COM.

- Monizze, a Belgian issuer of electronic meal vouchers, joins VASCO’s MYDIGIPASS.COM community.

- Ello Mobile, a Belgian virtual mobile network operator, protects customer data with MYDIGIPASS.COM.

- VASCO adds a virtual appliance to its IDENTIKEY product range offering hypervisor remote access security providing customers with the flexibility to choose the deployment model that best meets their unique security requirements.

- VASCO launched its enhanced IDENTIKEY Federation Server, which offers extended support for application and service providers.

- VASCO launches DIGIPASS 870 with "what you see is what you sign" functionality.

Guidance for full-year 2013:

VASCO is reaffirming its guidance for the full-year 2013 as follows:

- Revenue from our traditional business, which excludes our new service product offerings (DIGIPASS as a Service and MYDIGIPASS.COM), is expected to be in the range of $162 million to $167 million, and

- Operating income as a percentage of revenue, excluding the amortization of purchased intangible assets, is projected to be in the range of 12% to 14%.

“The results for the first quarter of 2013 were in line with our expectations,” stated T. Kendall Hunt, Chairman & CEO. “Similarly, the prospects for the business continue to be in line with the guidance we gave for the full year in February. During the first quarter, we continued to focus on the enhancement of our MYDIGIPASS.COM platform. We were pleased with the improvements included in our March release of the platform and have identified and added substantial additional improvements to our product roadmap. We have also made good progress in the first quarter in hiring sales staff that will focus on developing relationships with application service providers over the coming months.”

"The results for the first quarter reflected a 19% increase in revenues from the Banking market partially offset by a 21% decrease in revenues from the Enterprise and Application Security market," said Jan Valcke, VASCO's President and COO. "The decline in revenue from the Enterprise and Application Security market was due in large part to the fact that the first quarter of 2012 included an unusually large order that was not replaced by an order of a similar size in 2013. Given the order flow in the first quarter and the strength of our sales pipeline, we believe that the fluctuations in our quarterly revenues primarily reflect the transactional nature of our business. We do not believe that the continuing uncertain economic conditions in our core markets have had a significant negative impact on either our first quarter results or our outlook for the remainder of 2013."

Conference Call Details

In conjunction with this announcement, VASCO Data Security International, Inc. will host a conference call today, April 25, 2013, at 10:00 a.m. EDT - 16:00h CET. During the conference call, Mr. Ken Hunt, CEO, Mr. Jan Valcke, President and COO, and Mr. Cliff Bown, CFO, will discuss VASCO’s results for the first quarter 2013.

To participate in this conference call, please dial one of the following numbers:

USA/Canada: +1 800-272-0419

International: +1 303-223-2684

And mention VASCO to be connected to the conference call.

The Conference Call is also available in listen-only mode on www.vasco.com. Please log on 15 minutes before the start of the Conference Call in order to download and install any necessary software. The recorded version of the Conference Call will be available on the VASCO website 24 hours a day for at least 60 days.

EBITDA is a non-GAAP financial measure within the meaning of applicable U.S. Securities and Exchange Commission rules and regulations. We use EBITDA as a measure of performance, a simplified tool for use in communicating our performance to investors and analysts and for comparisons to other companies within our industry. As a performance measure, we believe that EBITDA presents a view of our operating results that is most closely related to serving our customers. By excluding interest, taxes, depreciation and amortization we are able to evaluate performance without considering decisions that, in most cases, are not directly related to meeting our customers’ requirements and were either made in prior periods (e.g., depreciation and amortization), or deal with the structure or financing of the business (e.g., interest) or reflect the application of regulations that are outside of the control of our management team (e.g., taxes). Similarly, we find that the comparison of our results to those of our competitors is facilitated when we do not need to consider the impact of those items on our competitors’ results.

EBITDA should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States. While we believe that EBITDA, as defined above, is useful within the context described above, it is in fact incomplete and not a measure that should be used to evaluate our full performance or our prospects. Such an evaluation needs to consider all of the complexities associated with our business including, but not limited to, how past actions are affecting current results and how they may affect future results, how we have chosen to finance the business and how regulations and the other aforementioned items affect the final amounts that are or will be available to shareholders as a return on their investment. Net income determined in accordance with U.S. GAAP is the most complete measure available today to evaluate all elements of our performance. Similarly, our Consolidated Statement of Cash Flows, which will be filed with the SEC as part of our report for the period covered by this release, provides the full accounting for how we have decided to use resources provided to us from our customers, lenders and shareholders.

VASCO is a leading supplier of strong authentication and e-signature solutions and services specializing in Internet Security applications and transactions. VASCO has positioned itself as global software company for Internet Security serving a customer base of approximately 10,000 companies in more than 100 countries, including approximately 1,700 international financial institutions. VASCO’s prime markets are the financial sector, enterprise security, e-commerce and e-government.

VASCO is a leading supplier of strong authentication and e-signature solutions and services specializing in Internet Security applications and transactions. VASCO has positioned itself as global software company for Internet Security serving a customer base of approximately 10,000 companies in more than 100 countries, including approximately 1,700 international financial institutions. VASCO’s prime markets are the financial sector, enterprise security, e-commerce and e-government.

Forward Looking Statements:

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. Such forward-looking statements are subject to certain risks, uncertainties and assumptions and include, among other things, our expectations regarding the DigiNotar bankruptcy process, the impairment of our investment in DigiNotar, the timeframe in which the impairment costs will be incurred, our ability to recover amounts held in escrow, our ability to offset amounts that may be owed to DigiNotar by other VASCO affiliates against amounts owed to VASCO affiliates by DigiNotar, and our ability to effectively integrate certain intellectual property assets previously used by DigiNotar into our operations, as well as the prospects of, and developments and business strategies for, VASCO and our operations, including the development and marketing of certain new products and the anticipated future growth in certain markets in which we currently market and sell our products or anticipate selling and marketing our products in the future. These forward-looking statements (1) are identified by use of terms and phrases such as “expect”, “believe”, “will”, “anticipate”, “emerging”, “intend”, “plan”, “could”, “may”, “estimate”, “should”, “objective”, “goal”, “possible”, “potential” and similar words and expressions, but such words and phrases are not the exclusive means of identifying them, and (2) are subject to risks and uncertainties and represent our present expectations or beliefs concerning future events. Although VASCO believes that our expectations are reasonable, we can give no assurance that these expectations will prove to be correct. VASCO cautions that the forward-looking statements are qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those contemplated above include, among others, unanticipated costs associated with DigiNotar’s bankruptcy or potential claims that may arise in connection with the hacking incidents at DigiNotar. Additional risks, uncertainties and other factors have been described in greater detail in our Annual Report on Form 10-K for the year ended December 31, 2012 and include, but are not limited to, (a) risks of general market conditions, including currency fluctuations and the uncertainties resulting from turmoil in world economic and financial markets, (b) risks inherent to the computer and network security industry, including rapidly changing technology, evolving industry standards, increasingly sophisticated hacking attempts, increasing numbers of patent infringement claims, changes in customer requirements, price competitive bidding, and changing government regulations, and (c) risks specific to VASCO, including, demand for our products and services, competition from more established firms and others, pressures on price levels and our historical dependence on relatively few products, certain suppliers and certain key customers. Thus, the results that we actually achieve may differ materially from any anticipated results included in, or implied by these statements. Except for our ongoing obligations to disclose material information as required by the U.S. federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

This document may contain trademarks of VASCO Data Security International, Inc. and its subsidiaries, including VASCO, the VASCO “V” design, DIGIPASS, VACMAN, aXsGUARD and IDENTIKEY.

For more information contact:

Jochem Binst, +32 2 609 97 00, [email protected]