Blend shares 3 best practices for digitizing lending workflows

Lending digitization is a strategic imperative for banks and credit unions. But as financial institutions improve their digital experiences, many find themselves asking: Are we just digitizing tasks, or are we truly transforming the experience from end to end?

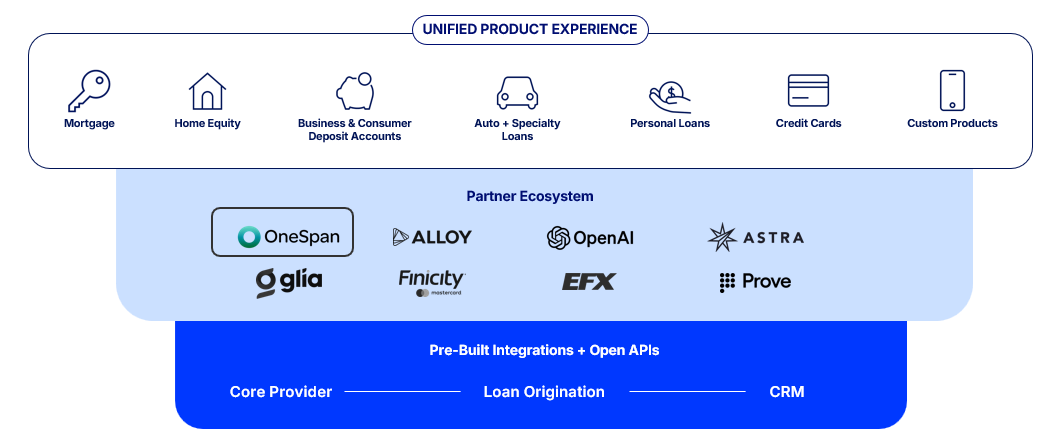

The team behind digital origination platform Blend understands how crucial it is for lenders to continuously evolve their digital processes. One way Blend is helping banks and credit unions enhance the lending experience is by developing prebuilt native integrations to both external data and related technology tools. Tools that remove friction and simplify processes for borrowers act as both a customer satisfaction lever and a revenue engine – underscoring how the right platform partner adds value to account origination, digital lending, and processes across the customer lifecycle.

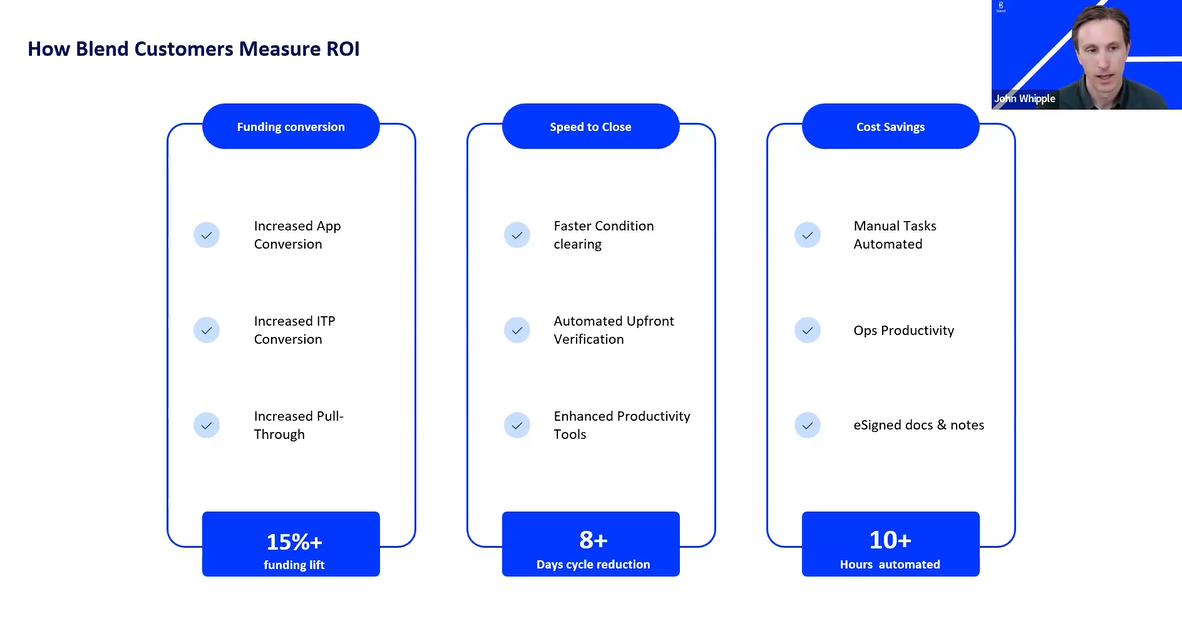

“In terms of the impact we've seen and how our customers think about ROI and investing in digital experiences, one metric is funnel conversion and driving initial applications all the way through to funding or closing. We've seen lenders that adopt these digital tools gain upwards of a 15% lift,” says John Whipple, product management lead with Blend.

During a recent webinar hosted by OneSpan highlighting Bank of Montreal’s (BMO) digital transformation efforts, John shared best practices he thinks will drive the greatest returns for financial institutions and their platform partners as they modernize lending. Read this blog for the quick summary.

Proven results: Blend customers achieve significant ROI through digital lending tools, with up to 15% improvement in funding conversion rates, 8+ days reduced in cycle time, and 10+ hours of manual work automated.

#1. Give customers flexibility to interact on their own terms

The versatility of a bank’s digital experience – the ability to offer consumers choice in how they transact and in what channel – has become an outsized factor in keeping customers happy.

“One use case that has been really powerful is being able to natively embed a digital experience around reviewing forms, eSigning them, and being able to do so remotely if that suits the customer’s need. That has been a critical component of our strategy of meeting a customer where they want to be met,” John says.

Consumers have become accustomed to convenient eSignatures in other areas of their lives, so it’s natural that they now expect the same from their financial services institution, especially for transactions such as obtaining a mortgage and auto financing. Even if some customers still prefer the old-fashioned way of signing a paper document, it’s vital to give them the option.

Legacy processes centered on physically signing documents often ignore the busy pace of consumers’ lives. Requiring in-person visits increases abandonment rates, leaving revenue opportunities on the table. “Digitizing helps remove parts of the process that might be more error-prone or require back-and-forth or scheduling with the borrower to come into a branch,” John says.

“All of that translates into meaningful cost savings by reducing time spent on manual tasks through automating. We've seen lift, in particular, with home lending transactions – being able to eSign not just some of the disclosure documents but the actual promissory note tied to the deed of the property. That has meaningful returns for lenders, both for cycle time and cost-saving benefits.”

#2 Use digitization to simplify lending

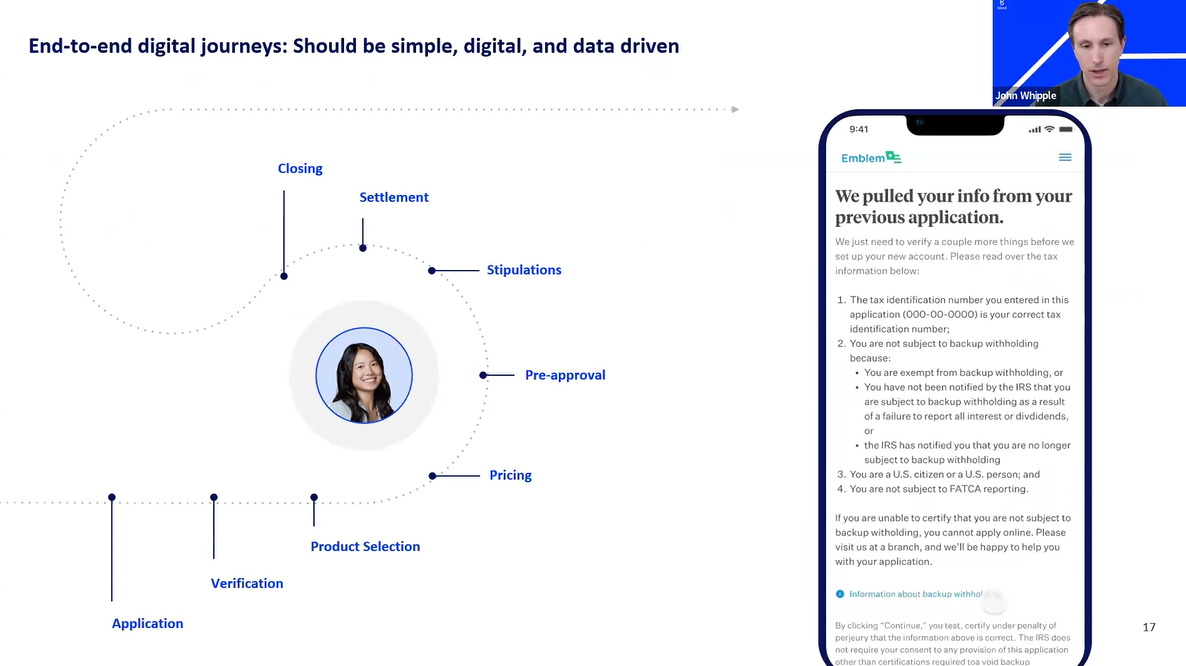

“We believe consumers are looking for a process that is as simple and easy as possible. Part of the strategy to drive simplicity is digitizing these processes,” Whipple says.

One way to do that is by eliminating the need for customers to type information into an application form, which invites error. Financial institutions already have a lot of data about a customer. Using it to connect with verifiable data sources to confirm a borrower’s income, etc., and then prefilling a smart form, simplifies the process and removes customer friction.

“Use your structured data to your advantage and enable seamless prefill between digital experiences and the eSign workflow,” John says.

Digital transformation in action: Blend's data-driven approach pre-fills customer information and streamlines complex lending journeys, reducing friction and eliminating the need for customers to re-enter known data.

When form fields are pre-populated so customers only have to confirm or update the data before form submission, it saves time. This also has a measurable impact on revenue.

“Processing efficiency is another metric we look at: taking time out of the process,” he said. “The cycle time reduction specifically for a home loan, like a mortgage or home equity – that’s an area where we’ve seen a reduction in the number of days start-to-finish.”

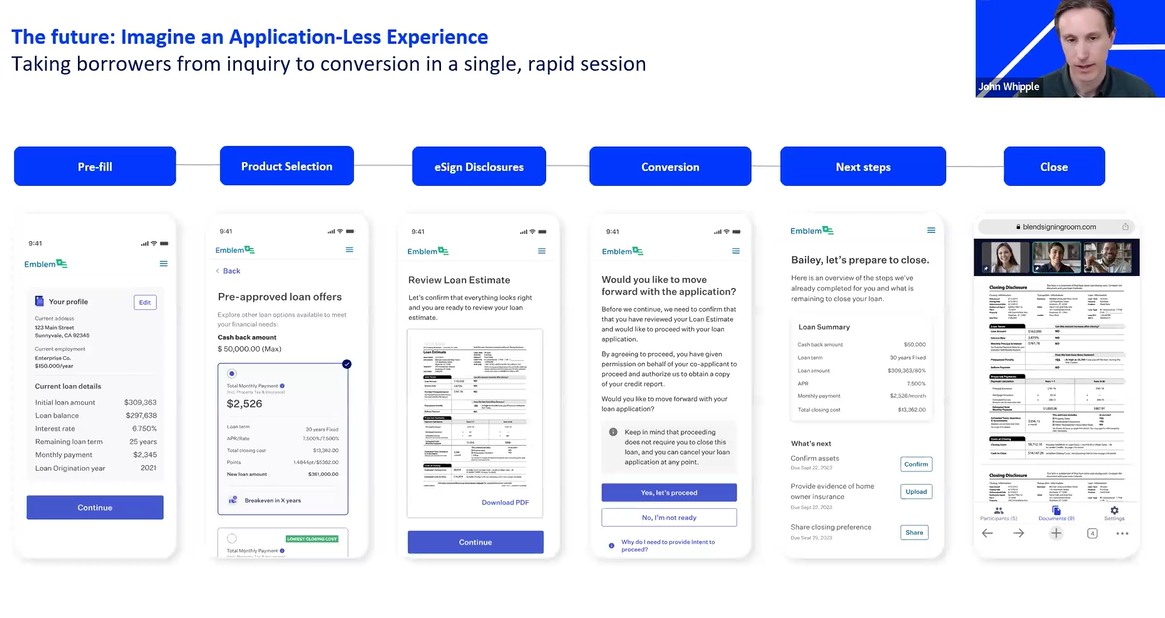

#3 Get ready for the application-less future

John also recommends that credit unions, banks, and lenders keep an eye to the future as they invest in digital lending experiences. For example, Blend sees a time where lending will no longer be oriented around getting the customer to apply, provide their information, and go through all the steps to get to closing, using the power of AI.

“We think we can make these experiences application-less,” he says. “The future of lending isn’t just about speeding up applications; it’s about eliminating them entirely.”

“Imagine presenting customers or members with tailored financial solutions delivered proactively, based on their profile, without cumbersome application flows. Not so different from your shopping experience with Amazon. Lending is heading in this direction.”

“By integrating data, automation [with tools like eSignature], and personalization into a single platform enables proactive journeys with instant decisions. This builds relationships by seamlessly connecting all consumer products to ultimately grow wallet share.”

The future of lending: Blend envisions an application-less experience where customers move seamlessly from initial inquiry to loan closing in a single digital session, powered by pre-filled data and integrated eSignature workflows.

Unlock new revenue streams with embedded signing powered by OneSpan

Seamless lending workflows are best achieved through strategic partnerships, like Blend’s with OneSpan. Partnering with a trusted, secure eSignature solution allows account origination platforms, loan origination platforms, digital lending platforms, and other similar providers to offer their customers the tools they need.

Blend's unified digital platform integrates with a rich partner ecosystem, including OneSpan for eSignature capabilities, to deliver seamless customer experiences.

During his presentation, John pointed to Blend’s work with OneSpan Sign as a strong example of eSignature done well, saying, “OneSpan has enabled us to have a seamlessly embedded digital application experience. It takes what used to be a very analog, manual, friction-filled process and makes it digital and automated.”

The result? “Year to date, we’ve seen over a million documents go through a digital signing experience.”

For technology vendors such as independent software vendors (ISVs) and OEMs looking to deliver similar value, programs like the OneSpan Partner Program offer the tools, support, and flexibility to embed secure eSignature capabilities into their platforms and lending system software — helping accelerate time to market and unlock new revenue streams.

With more than 30 years of experience, OneSpan helps OEM and ISV partners elevate electronic signing capabilities, deliver improved digital workflows, remove customer friction, and provide exceptional value to their customers. Learn more about partnering with OneSpan.