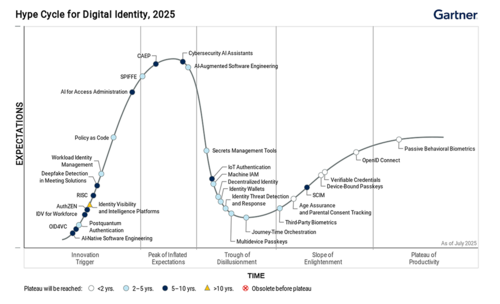

Read the Gartner® Hype Cycle for Digital Identity, 2025

A fresh look at what’s shaping the future of identity.

The latest Gartner Hype Cycle explores where digital identity is headed – from AI-native platforms to decentralized credentials – and what security leaders need to pay attention to next.

Inside this report:

- A look at which innovations, like FIDO2, identity threat detection, and passkeys, are gaining real traction

- The Gartner take on where decentralized identity and verifiable credentials go next, including OID4VC (OpenID for Verifiable Credentials) and AuthZEN (authorization standard)

- Analyst recommendations on what to adopt now, what to track, and what’s likely overhyped

Read the report now

Why it matters

Digital identity is more than a login box, it’s the control plane for access, security, and trust. As hybrid work expands and threats evolve, identity has become the primary attack surface—and the foundation for Zero Trust.

The Gartner® Hype Cycle for Digital Identity, 2025 cuts through the buzzwords and maps which innovations are ready, which are rising, and which might not make it at all.

Whether you’re modernizing IAM or rethinking how identity fits into your broader security strategy, this report gives you the clarity to move forward with confidence.

Gartner does not endorse any vendor, product or service depicted in its research publications and does not advise technology users to select only those vendors with the highest ratings or other designation. Gartner research publications consist of the opinions of Gartner’s research organization and should not be construed as statements of fact. Gartner disclaims all warranties, expressed or implied, with respect to this research, including any warranties of merchantability or fitness for a particular purpose.

GARTNER is a registered trademark and service mark of Gartner and Hype Cycle are a registered trademark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and are used herein with permission. All rights reserved.

This graphic was published by Gartner, Inc. as part of a larger research document and should be evaluated in the context of the entire document. The Gartner document is available upon request from OneSpan.