Executive Summary

Business Objectives

- Digitize and automate all processes involving signatures, starting with life insurance applications and contracts for their 3,000 independent brokers

- Ensure compliance with Greece’s data privacy law, which requires clients to consent to their data being processed

The Solution

- Go paperless, save time, and simplify the customer and broker experience with OneSpan Sign

- Deployed as a cloud service with EU data hosting

The Results

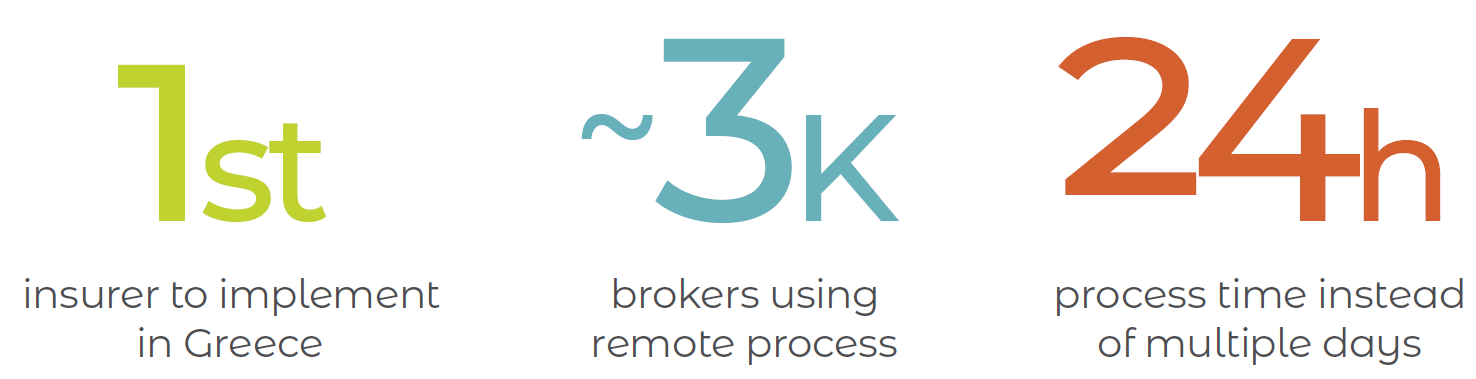

- Reduced time to complete life insurance applications from several days to less than 24 hours

- OneSpan Sign API streamlined e-signature integration into existing apps

- Proof of compliance with legal requirements for consent

- Full business continuity during COVID-19

This insurance provider established an end-to-end digital process for their life insurance offering before the pandemic and grew at a time that challenged other insurers.

Generali is one of the largest global insurance and asset management providers. Established in 1831, it is present in 50 countries in the world, with more than 72 thousand employees serving 65.9 million customers (Figures as of December 31, 2020).

The Greek parliament passed Law 4624/2019, a new data protection legislation that directly impacted the Greek division Generali Hellas. The legislation requires all members of an insured family over the age of 15 to sign consent documents. This created a frustrating experience for the customer as they would be obligated to come into the broker’s office to sign paperwork in-person. Further, this extra step delayed the process, adding days or weeks to deliver a quote to the customer.

Generali built one of the first end-to-end digital processes in Greece for their life insurance customers and leveraged OneSpan Sign electronic signatures to expedite the quote process while ensuring compliance. When the COVID-19 pandemic hit, Generali was well poised to switch to a remote business model. In an industry climate that challenged their competitors, Generali was increasing its market share.

Through our partnership with OneSpan, we are able to deliver our e-sign service and secure digital policy delivery. Generali pioneered the launch of this technology in Greece, and the positive feedback we have received from both customers and brokers, as well as the noticeable business benefits, are key factors in our decision to expand the use of the e-sign service to other products lines as well.

The Solution

Electronic signatures were a component of a larger digital transformation in Generali Hellas in which all processes were slated to undergo a gradual digitization to create automation and efficiency. To start, electronic signatures were deployed to fulfill two use cases: the customer consent forms that are part of the life insurance process, and contracts and agreements with independent brokers.

Client Use Case: Digital Consent Forms

Generali describes their digital transformation as a strategic pillar of the organization. Their in-house IT department and ongoing digital projects are examples of their commitment to improving their processes with technology. Generali Hellas prides itself on being a leader in the Greek insurance industry, and their end-to-end digital process for life insurance was one of the first of its kind in the country.

Generali began by integrating OneSpan Sign into their OneView application for brokers. The integration required only a few weeks. “This was one of the reasons we chose OneSpan Sign,” explains Antonis Apergis, “Our primary selection criteria was to be able to seamlessly embed e-signature into our existing applications. OneSpan Sign provided a simple, yet rich API that allowed us to quickly integrate into OneView.”

The workflow begins with initial consent forms that permit the underwriting process and allow the insurer to ask relevant health questions to inform the quote. From there, brokers invite the customer and family members covered by the policy to e-sign the consent forms remotely at their convenience using their preferred device. From there, Generali processes the quote. Soon after, the customer receives their quote and policy through email where the customer can acknowledge and confirm their insurance purchase.

The digital process proved to be expedient, straightforward, and a prescient decision by Generali. Initially Generali’s brokers believed that digitizing these forms would diminish the in-person rapport that the brokers work so hard to cultivate with customers. Once implemented, the brokers discovered that the automated process helped them complete signatures faster, reduced administrative paperwork, and freed their time to focus on bringing in more business.

Further, after the COVID-19 pandemic and resulting lockdowns obligated remote meetings and digital processes, Generali was well positioned to transition to a digital brokerage team, and brokers benefitted from the electronic signature solution to help them service their customers without interruption. This ensured business continuity and became a competitive advantage as other insurers attempted to spin up their digital processes.

Broker Use Case: Compliance and Convenience

The Insurance Distribution Directive (IDD) regulates the sale of insurance in the European Union and mandates that brokers provide a level of transparency when working with customers. Compliance involves signing numerous documents, including an annual contract agreement between each broker and the insurance company. E-Signature technology makes it easy for Generali to gather thousands of signatures from their brokers in a fraction of the time it takes competitors who are still working with paper. And by using the standalone OneSpan Sign web service for this use case, Generali was able to automate their broker contract process immediately.

The Results

After a successful deployment, the full team of ~3,000 brokers began to use this process with their customers. When the government response to the COVID-19 pandemic mandated social distancing and stay-at-home orders, the new digital process allowed Generali to transition seamlessly to remote work.

In a business environment in which Generali’s competitors saw a serious decrease in productivity, Generali Hellas implemented digital solutions, including e-signature, as part of a larger strategy to digitally transform their operation model. The strategy contributed to Generali strengthening their market position with an +8% increase in production compared to 2019, steadily growing their market share at 6%.

This was especially important during the pandemic where digital solutions allowed business continuity. Their digital process, enabled by electronic signature, allowed them to gain ground in a year where others were scrambling to adjust to the sudden shift to remote operations.

The digital solution with e-signatures proved so successful, the organization is planning to expand e-signatures to other products and lines of business as well. Their brokerage and sales team, happy with the e-signature service, stands to benefit once again from the increased efficiency and customer experience of an end-to-end digital process.