HIGHLIGHTS

Reduce fraud

- The combination of risk analytics with machine learning and pre- configured rule-sets stops more account takeover fraud and simplifies deployment

Quickly meet regulatory requirements

- Leverage multi-factor authentication, risk analytics and mobile security to meet PSD2, GDPR and other strict regulations

Drive growth

- Dramatically reduce friction across digital channels to provide the best customer experience

Banks and financial institutions face record fraud losses each year, tied primarily to account takeover fraud, as well as strict regulatory compliance requirements. And addressing these challenging demands needs to be accomplished while satisfying customer expectations for seamless digital interactions across devices, channels and locations.

OneSpan Intelligent Adaptive Authentication enables banks and financial institutions to stop more fraud, meet compliance requirements faster, reduce operational costs while providing the best user experience. Our solution does this by leveraging high performance cloud and service technologies like orchestration, containers and micro-services along with proven risk analytics, multi-factor authentication and mobile security.

Optimize user journeys, while reducing risk and costs

- Customer experience: Deliver a consistent and frictionless user experience across digital channels to increase loyalty and services utilization

- Risk and fraud: Stop more fraud, including account take-overs, with a powerful risk analytics engine leveraging machine learning

- Compliance: Meet the strictest compliance requirements, including PSD2, with strong customer authentication, risk analytics and mobile security

- Visibility and control: Unique and intuitive administration with the power to make authentication changes to the largest end user populations in minutes

- Seamless integration of third party fraud and authentication technologies

- Reduce deployment time and cost by leveraging the latest orchestration technology along with pre-configured machine learning models and rule sets

Benefits by business owner

- Business managers:

Fast, frictionless user experience; consistency across devices; faster time-to-market for new capabilities - Security & fraud managers:

Advanced authentication options including behavioral biometrics; fast integration of new fraud technologies; leading risk analytics leveraging machine learning - Compliance managers:

Single platform approach to compliance; simplified audit process; support for EU PSD2 and GDPR - IT managers:

Fast integration of new endpoint technologies; flexible applications; dramatically less coding, development and complexity

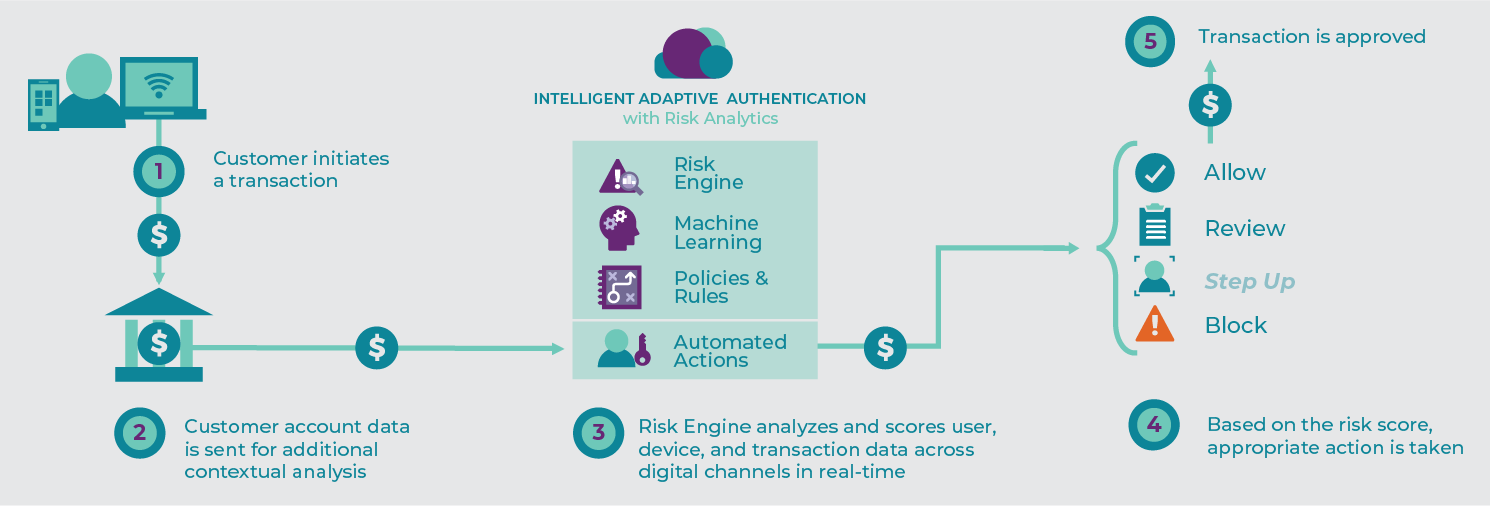

How it works

Intelligent Adaptive Authentication step-by-step

OneSpan Intelligent Adaptive Authentication analyzes and scores hundreds of user actions, as well as device and transaction data, in real-time, to determine the precise authentication requirements for each transaction.

- Steps 1-2: Collects comprehensive data on the integrity of the device and mobile apps, the behavior of the user, transaction details and other key contextual data across all digital channels.

- Steps 3: Leverages the machine learning equipped risk analytics engine, powering the intelligence of our Adaptive Authentication solution, to analyze and score each transaction to get the most clear and complete view of fraud.

- Step 4: Takes action based on a precise risk score. So higher risk transactions will dynamically initiate a stepup authentication process and lower risk transactions flow with no additional security steps.

- Step 5: Transaction is completed and money, in this example, is transferred seamlessly.

Key differentiators

- Deep visibility to and security of mobile devices and apps via app shielding, device binding, jailbreak/root detection, device ID, secure storage, obfuscation and more

- Support extensive biometric capabilities including fingerprint, face recognition and FaceID

- Pre-configured and customizable rule-sets combined with supervised and unsupervised machine learning algorithms to better detect fraud in real-time

- Future-proof platform that supports seamless third party technology integrations

- Supports strong multi-factor authentication and transaction signing

- Supports an extensive mix of both software and hardware authentication technology

- Dynamic, risk-based authentication orchestration enables precise security for each unique user journey

- Continuous transaction monitoring pro-actively detects and mitigates fraud across digital channels