VASCO reports Q1 2012 results

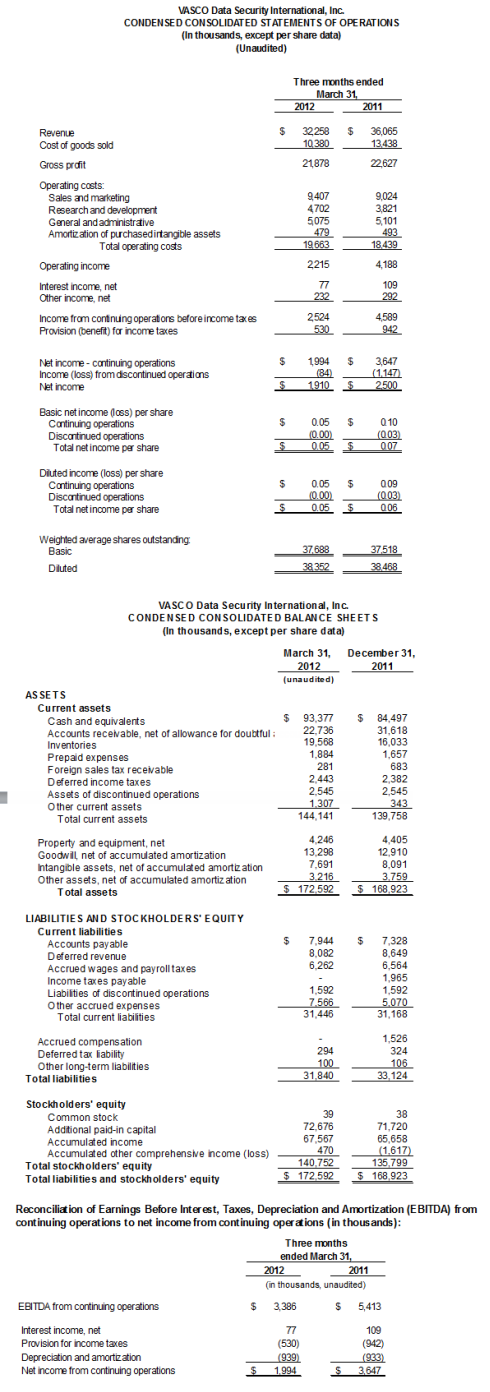

Revenue from continuing operations for the first quarter of 2012 was $32.3 million, a decrease of 11% compared to the first quarter 2011; Operating income from continuing operations for the first quarter of 2012 was $2.2 million, a decrease of 47% compared to the first quarter 2011. Financial results for the period ended March 31, 2012 and guidance for full-year 2012 to be discussed on conference call today at 10:00 a.m. E.D.T.

OAKBROOK TERRACE, IL, and ZURICH, Switzerland, April 26, 2012 - VASCO Data Security International, Inc. (NASDAQ: VDSI) (www.vasco.com), today reported financial results for the first quarter ended March 31, 2012.

Revenue from continuing operations for the first quarter of 2012 decreased 11% to $32.3 million from $36.1 million in the first quarter of 2011. Net income from continuing operations for the first quarter of 2012 was $2.0 million, or $0.05 per fully diluted share, a decrease of $1.7 million, or 45%, from $3.6 million, or $0.10 per fully diluted share, for the first quarter of 2011.

Net income, which includes the impact of our discontinued operations, for the first quarter of 2012 was $1.9 million, or $0.05 per diluted share. Net income for the first quarter of 2011 was $2.5 million, or $0.06 per diluted share.

- Gross profit from continuing operations was $21.9 million, or 68%, of revenue for the first quarter of 2012. Gross profit was $22.6 million, or 63%, of revenue for the first quarter of 2011.

- Operating expenses from continuing operations for the first quarter 2012 were $19.7 million, an increase of 7% from $18.4 million reported for the first quarter 2011. Operating expenses for the first quarter of 2011 included $0.6 million of non-cash compensation expenses and $0.5 million of amortization expense related to purchased intangible assets.

- Operating income from continuing operations for the first quarter 2012 was $2.2 million, a decrease of $2.0 million, or 47%, from $4.2 million reported for the first quarter of 2011. Operating income as a percentage of revenue in the first quarter 2012 was 7% compared to 12% in the first quarter of 2011.

- Earnings before interest, taxes, depreciation and amortization from continuing operations were $3.4 million for the first quarter 2012, a decrease of 37% from $5.4 million reported for the first quarter of 2011.

- Net cash balances, total cash and cash equivalents less bank borrowings, at March 31, 2012 totaled $93.4 million compared to $84.5 million at December 31, 2011. There were no bank borrowings at either March 31, 2012 or December 31, 2011.

VASCO launched the next step in its DIGIPASS as a Service strategy with a new free services program for web application providers/web site owners.

- CDS (Condomínio de Soluções Corporation), a vendor and business solutions integrator, chose DIGIPASS GO3 with IDENTIKEY to enhance the security of the business intelligence retail program it developed for General Motors Brazil.

- TechMag, a distributor of VASCO’s solutions in Brazil, chose DIGIPASS GO 3 and DIGIPASS for Mobile 3.0 to protect its infrastructure.

- VASCO launched a new optical e-signature device, DIGIPASS 736, with adaptive signing functionality.

- VASCO showcased its first acoustic smart card reader, DIGIPASS 837, at CeBIT.

VASCO is reaffirming its guidance for the full-year 2012 as follows:

- Revenue for 2012 is expected to be $175 million or more, and

- Operating income as a percentage of revenue, excluding the amortization of purchased intangible assets, for full-year 2012 is projected to be in the range of 13% to 16%.

“While total revenues were below our expectations in the first quarter of 2012, our intake of new orders and our pipeline of potential orders remained strong throughout the period,” stated T. Kendall Hunt, Chairman & CEO. “Revenues were generally lower than we expected due to the timing of receipt of new orders and production delays associated with the Chinese New Year. The outlook for the full-year 2012, however, continues to be strong and on track with our previous expectations. We continue to believe that 2012 will be a year in which we fortify and enhance our strong position in our core business while we develop the market for our DIGIPASS as a Service business line.”

"The results for the first quarter reflected an 18% decline in revenues from the Banking market partially offset by a 29% increase in revenues from the Enterprise and Application Security market," said Jan Valcke, VASCO's President and COO. "The decline in revenue from the Banking market primarily reflects the fact that we had unusually large orders in our backlog entering into 2011 that were not replaced by orders of a similar size in our backlog entering 2012. Order intake through the first quarter of 2012, however, has been the best in our history and we are narrowing the gap in the order backlog at the beginning of the year. We were also pleased with the improvement in our gross margin rate, which increased from 63% in 2011 to 68% in 2012."

Cliff Bown, Executive Vice President and CFO added, “During the first quarter of 2012 our cash and working capital balances continued to increase. At March 31, 2012 we had working capital $112.7 million, an increase of $4.1 million, or 4%, from December 31, 2011 and our net cash balance was $93.4 million, an increase of $8.9 million or 11% from December 31, 2011.”

In conjunction with this announcement, VASCO Data Security International, Inc. will host a conference call today, April 26, 2012, at 10:00 a.m. EDT - 16:00h CET. During the conference call, Mr. Ken Hunt, CEO, Mr. Jan Valcke, President and COO, and Mr. Cliff Bown, CFO, will discuss VASCO’s results for the first quarter 2012.

To participate in this conference call, please dial one of the following numbers:

USA/Canada: +1 800-920-4316

International: +1 212-231-2921

And mention VASCO to be connected to the conference call.

The Conference Call is also available in listen-only mode on www.vasco.com. Please log on 15 minutes before the start of the Conference Call in order to download and install any necessary software. The recorded version of the Conference Call will be available on the VASCO website 24 hours a day for at least 60 days.

EBITDA is a non-GAAP financial measure within the meaning of applicable U.S. Securities and Exchange Commission rules and regulations. We use EBITDA as a measure of performance, a simplified tool for use in communicating our performance to investors and analysts and for comparisons to other companies within our industry. As a performance measure, we believe that EBITDA presents a view of our operating results that is most closely related to serving our customers. By excluding interest, taxes, depreciation and amortization we are able to evaluate performance without considering decisions that, in most cases, are not directly related to meeting our customers’ requirements and were either made in prior periods (e.g., depreciation and amortization), or deal with the structure or financing of the business (e.g., interest) or reflect the application of regulations that are outside of the control of our management team (e.g., taxes). Similarly, we find that the comparison of our results to those of our competitors is facilitated when we do not need to consider the impact of those items on our competitors’ results.

EBITDA should be considered in addition to, but not as a substitute for, other measures of financial performance reported in accordance with accounting principles generally accepted in the United States. While we believe that EBITDA, as defined above, is useful within the context described above, it is in fact incomplete and not a measure that should be used to evaluate our full performance or our prospects. Such an evaluation needs to consider all of the complexities associated with our business including, but not limited to, how past actions are affecting current results and how they may affect future results, how we have chosen to finance the business and how regulations and the other aforementioned items affect the final amounts that are or will be available to shareholders as a return on their investment. Net income determined in accordance with U.S. GAAP is the most complete measure available today to evaluate all elements of our performance. Similarly, our Consolidated Statement of Cash Flows, which will be filed as part of our annual report on Form 10-K, provides the full accounting for how we have decided to use resources provided to us from our customers, lenders and shareholders.

VASCO is a leading supplier of strong authentication and e-signature solutions and services specializing in Internet Security applications and transactions. VASCO has positioned itself as global software company for Internet Security serving a customer base of approximately 10,000 companies in more than 100 countries, including approximately 1,700 international financial institutions. VASCO’s prime markets are the financial sector, enterprise security, e-commerce and e-government.

VASCO is a leading supplier of strong authentication and e-signature solutions and services specializing in Internet Security applications and transactions. VASCO has positioned itself as global software company for Internet Security serving a customer base of approximately 10,000 companies in more than 100 countries, including approximately 1,700 international financial institutions. VASCO’s prime markets are the financial sector, enterprise security, e-commerce and e-government.

Forward Looking Statements:

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and Section 27A of the Securities Act of 1933. These forward-looking statements (1) are identified by use of terms and phrases such as “expect”, “believe”, “will”, “anticipate”, “emerging”, “intend”, “plan”, “could”, “may”, “estimate”, “should”, “objective”, “goal”, “possible”, “potential” and similar words and expressions, but such words and phrases are not the exclusive means of identifying them, and (2) are subject to risks and uncertainties and represent our present expectations or beliefs concerning future events. VASCO cautions that the forward-looking statements are qualified by important factors that could cause actual results to differ materially from those in the forward-looking statements. Factors that could cause actual results to differ materially from those contemplated above include risks, uncertainties and other factors have been described in our Annual Report on Form 10-K for the year ended December 31, 2011 and include, but are not limited to, (a) risks of general market conditions, including currency fluctuations and the uncertainties resulting from turmoil in world economic and financial markets, (b) risks inherent to the computer and network security industry, including rapidly changing technology, evolving industry standards, increasingly sophisticated hacking attempts, increasing numbers of patent infringement claims, changes in customer requirements, price competitive bidding, and changing government regulations, and (c) risks specific to VASCO, including, demand for our products and services, competition from more established firms and others, pressures on price levels and our historical dependence on relatively few products, certain suppliers and certain key customers. Thus, the results that we actually achieve may differ materially from any anticipated results included in, or implied by these statements. Except for our ongoing obligations to disclose material information as required by the U.S. federal securities laws, we do not have any obligations or intention to release publicly any revisions to any forward-looking statements to reflect events or circumstances in the future or to reflect the occurrence of unanticipated events.

This document may contain trademarks of VASCO Data Security International, Inc. and its subsidiaries, including VASCO, CertiID, DIGIPASS, VACMAN, aXsGUARD IDENTIKEY, the VASCO “V” design, and the dP+ design.

For more information contact:

Jochem Binst, +32 2 609 97 00, [email protected]