Biometric Identity Verification: Trends in Facial Biometrics

As facial comparison and facial recognition become more commonplace in our lives, what are the next key trends for facial biometrics?

The IT super-companies, such as Google, Facebook, and Amazon, are all investing heavily in this area with a particular focus on liveness detection and emotion detection.

Facial Biometric Trends

Liveness Detection

Critical to any facial biometric technique is the ability to detect spoofing and fraudulent behavior. The most common form of spoofing is to present a previously obtained static picture of an individual for comparison against the trusted source image. In order to counteract this and ensure the presence of the person, some form of liveness detection can be employed.

Many different methods of liveness detection are available on the market today. The most common form of liveness detection instructs the user to carry out a series of head movements to prove liveness. More advanced techniques, such as 3D recognition and thermal imaging, require specialist hardware and are not suitable to everyday commercial applications.

Emotion Recognition

Initially used unsuccessfully as an anti-terrorism device in the mid 2000’s, emotion recognition is once again of interest. But, this time it is in the context of a commercial application. The ability to determine the emotional state of an individual from a digital image can be used to improve customer experience or potentially influence a consumer's behavior.

Emotion recognition has been used for fatigue detection in car safety systems. Computer game designers are also using emotion recognition technology to detect the correct response from players is being achieved at particular points in a game. As the technology proliferates, humans can expect to interact with computer systems that can express empathy or at least have some degree of emotional intelligence.

There are multiple techniques being developed to recognize emotions in a digital image of a face. At a basic level, the subject’s face is digitally transformed into a facial feature dataset and compared against a pre-defined emotional classification model.

However, the technology is still being refined. Reliable classification models are difficult to create and require artificial intelligence (AI) learning tools to build and refine them. Differences in the way the same emotion is expressed between nationalities and races needs to be accounted for in any classification model.

Facial Biometrics vs Facial Comparison

Application fraud and account takeover fraud continue to challenge banks and other FIs. Recent research from Aite Group revealed that application fraud was second only to account takeover fraud as the biggest fraud challenge for financial institutions.

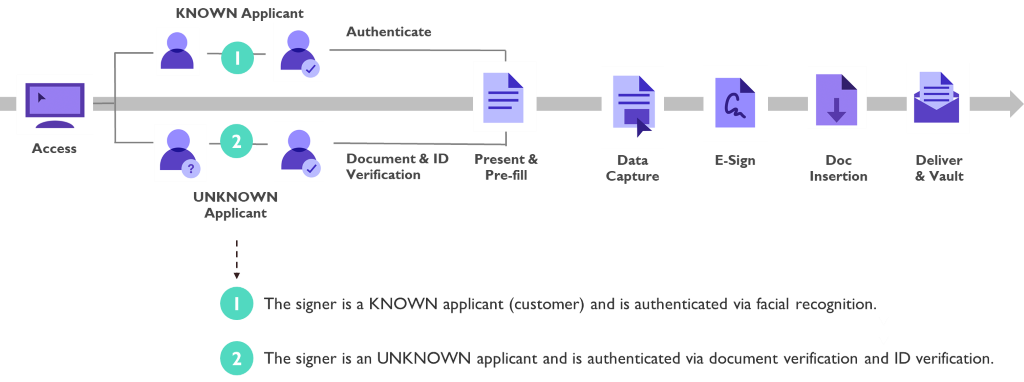

FIs can use facial biometrics to help fight fraud by validating a user’s identity in real-time – whether that user is online or on their phone. Whether facial recognition or facial comparison technology is used depends on whether a user is known or unknown.

If a user is unknown (e.g. in the case of a net-new customer applying remotely for a new account), then FIs can use facial comparison to compare a live image of the applicant with the image on a verified ID document to prove that a user is not fraudulently attempting to open an account. Facial comparison can also help FIs comply with Know Your Customer (KYC) requirements during new account opening.

If a user is known (e.g. in the case of an existing customer), then FIs can use facial recognition to authenticate that a user is genuine and not fraudulently trying to access an account.

Future Possibilities for Human Identity Authentication Automation

Facial comparison and facial recognition are being used by financial institutions, enterprises, and governments for a wide array of use cases – from fighting fraud to payments, cross-border customs, law enforcement, and access. No technology is completely foolproof, however, and industry, privacy, and consumer adoption need to be considered in any application of facial biometric technology. The endless possibilities and benefits the technology could bring should be weighed against concerns for public privacy as well as the technology’s capacity for abuse.

As biometric technology applications continue to expand, universal standards may be developed to regulate the use of biometrics for human identity authentication automation and aid interoperability across geographical borders. For now, the benefits of facial biometrics for financial institutions during digital account opening and for fraud prevention remain clear.