Executive Summary

Business Objectives

- Transform and digitize the business to ensure a fully digital flow across systems, channels, and operations

The Problem

- Paper processes introduced friction at the point of sale and made it difficult for agents to close business in a single visit

The Solution

- Private cloud deployment of OneSpan Sign

- Integrated with the carrier’s core system (Solife) and also the LuxTrust Qualified Timestamp service

- Built the foundation for an enterprise shared service so other lines of business can easily access e-signature (with life insurance as the first use case)

The Results

- Agents can finalize life insurance applications in as little as 15 minutes

- Digital workflow accelerates policy issuance

- Positive feedback from agents & clients

As part of a multi-year modernization initiative, the Group’s P&V Insurance business is investing €112 million to overhaul its tech stack and digitize its life and non-life business. 2 Since 2016, the company has phased out all legacy mainframe systems and introduced improvements ranging from business process automation to e-forms and digital document repositories.

However, one missing piece held the company back from achieving end-to-end digital flows: the ability to capture customers’ signatures electronically. In 2017, P&V Insurance launched an initiative to introduce electronic signatures across the business, starting with life insurance. While e-signature is only one component of the larger transformation, the company recognizes the strategic value this technology can bring to their entire operations – for everything from the agent channel to online direct sales, and even non-insurance processes.

P&V saw an opportunity out the gate to build foundational digital capabilities for the future. Led by IT in collaboration with the business, the carrier developed a routing application that would enable other lines of business to access e-signatures faster and more efficiently.

The e-signature functionality is an essential part of the digital flow. If it wasn’t there, it would clearly break the digital flow. That would have a serious impact on the customer experience because with paper, we would not be able to deliver the best experience or value.

The Challenge

P&V Insurance faced three challenges:

- Modern customer and agent experience: In Belgium, as around the world, the insurance industry is highly regulated and deeply dependent on documentation. Processing paperwork is expensive, time consuming, and prone to error. The carrier needed to eliminate paper and go endto-end digital to make it easier for agents and clients to do business. For example, prior to e-signatures, clients applying for life insurance generally could not complete the application with their agent in a single session. During the initial meeting, the agent and client would fill out the application on the agent’s laptop – but if no printer was available, the agent would have to return to the office, print the completed application, and either drive back to the customer for signature or send it through the mail. Once the customer had signed the paper application, the agent was then responsible for scanning, mailing, or faxing it back to the home office for processing. All of this manual effort was extremely inefficient and fell short of the modern customer experience the company aspired to.

- Digital Enterprise Transformation: P&V was undergoing a major business transformation that affected more than their front-end application process. They needed to implement a flexible e-signature solution that could be scaled to extend the efficiency of digital across the enterprise, including internal processes and processes that were not specific to insurance.

- Competitive Pressure: The carrier saw competitors increasingly introducing e-signature functionality and needed to keep pace with the industry. For P&V Insurance, maintaining a competitive edge meant providing their captive agents with the tools they need to deliver exceptional, convenient service.

Key Requirements

In summer 2017, P&V Insurance established an evaluation committee that included the business, IT, and Corporate Legal and Compliance. The Legal department was involved in the e-signature project from the start, to ensure compliance and determine appropriate use cases for Advanced versus Qualified E-Signatures. (See next page for details)

While the evaluation committee had an immediate need in their life insurance agent channel, the goal was to roll out the e-signature solution across multiple departments and lines of business over time. As a result, scalability was a key requirement, as was flexibility, ease of use, auditability, security, and the ability to host the integrated e-signature service on a private cloud.

The committee initially considered five vendors and shortlisted two: OneSpan and a local vendor. OneSpan distinguished itself as the right vendor for a number of reasons:

- Flexibility: The right e-signature solution would support any signing requirement, including Advanced and Qualified E-Signatures, various authentication options needed for online or F2F scenarios, multiple signers, click-to-sign and hand-scripted signing methods, and more. This would allow P&V to tailor the signing workflow to any use case, while providing a secure and intuitive user experience as well as a fully compliant process. “Our first implementation was one document, with one signature from the policyholder. But we knew we would need a lot of flexibility moving forward. We evaluated and made choices based on the needs that we anticipated for the future,” says Rogier Dickmann, Project Manager for Identity and Access Management & E-Signature.

- Ease of use: It was important to ensure the solution would be easy for senders, signers, and even IT. P&V needed a solution that would enable its agents (and eventually other business users) to initiate the signing ceremony quickly and easily. The solution also had to be easy for clients to e-sign. And finally, it had to be easy for developers to integrate because they had to get to market quickly with e-signatures. “It was a must-have for the business to be able to start with this new front-end application in a fully digital process,” says Marc Vaeyendries, Manager, Digital Projects Portfolio. OneSpan had the expertise and consultative approach that P&V required, along with an open API, comprehensive API documentation, sandbox, and developer forums. “What was especially helpful was the OneSpan Sign sandbox environment in the early stages, so our developers could test different possibilities.”

- Auditability: Strong audit capabilities help demonstrate compliance. To ensure the most reliable audit trails, the company needed an e-signature solution that could be integrated with a SaaS-based and eIDAS-compliant Qualified Timestamp service from a Trusted Certificate Authority such as LuxTrust, for third-party date and time stamping on all e-signed records.

Both shortlisted vendors were able to deliver on the functional requirements, but OneSpan was a better fit, more aligned with the P&V way of working. OneSpan’s reps were well prepared in all our meetings and it gave us a strong sense of confidence that OneSpan would make us successful. From the first demo with OneSpan, we discussed business issues like user adoption and this gave us the confidence to move forward with OneSpan as a trusted partner.

- Security: Trust and security are at the heart of digital transformation – and even more so for heavily regulated organizations. It was critical that P&V select an e-signature vendor who could meet their requirements for document security, strong authentication, cloud security, data residency, and data privacy.

- Flexible Pricing: “We also liked OneSpan’s flexible pricing. Because e-signature is a new technology for us, it was difficult to estimate the annual use of the service. Having a partner who can offer a pricing model that grows as we grow, was more attractive than a vendor with just a fixed price,” says Rogier Dickmann.

Advanced & Qualified E-Signatures under eIDAS

In the EU, the eIDAS regulation provides a common legal framework for the use of e-signatures. eIDAS defines three levels of electronic signature: Simple, Advanced, and Qualified. The Simple E-Signature optimizes customer experience and provides moderate signer assurance. At the other end of the spectrum is the Qualified E-Signature. It provides the highest level of signer assurance, because it requires in-person identity verification.

For P&V Insurance, the question became: How to choose the right type of e-signature for each use case? The initial use case is life insurance applications – a low risk process where the compliance requirements are minimal.

“The insurance application does not have the same level of risk as the policy, therefore an Advanced E-Signature is sufficient. However, for documents that need strong legal enforceability, such as the policy itself or the beneficiary change form, we need Qualified E-Signatures or even ink signatures to be compliant,” says Marc Lucion, Senior IT Project Manager.

“There is a constraint actually in the use of the Qualified E-Signature, which is not linked to e-signature technology, but to consumer behavior. Research shows that only 8 - 10% of the people in Belgium have memorized the PIN of their eID card. Which means that most of the time, if you ask people to use their eID with the PIN – which is a requirement for the Qualified E-Signature – they won’t be able to until they go back and look up the code at home. If you want to do a quick signing ceremony, you are actually much better off with a onetime password.”

We advised the business to use Qualified E-Signatures (with government-issued eID and PIN) at least for certain acts or contracts in function of the risk, sensitivity, or amount. However, we also agreed that Advanced E-Signatures (with authentication and SMS one-time passcode) were legally sufficient for most insurance applications. In all cases, the e-signed documents had to be kept and archived in our systems.

eIDAS REQUIREMENTS

The electronic signature must be:

- Applied by the person associated with the signature

- Applied in a manner that demonstrates the intent of the signer

- Associated with the document or data the signer intended to sign

This form of e-signature adds four additional requirements. The advanced electronic signature must:

- Be uniquely linked to the signer

- Identify the signer

- Be under sole control of the signer

- Detect changes to the document or data after the application of the AES

This is an advanced electronic signature that, in addition, must be:

- Created using a QES creation device

- Supported by a qualified certificate (that is issued to the signer in a form he or she can keep under his or her control)

First Use Case: Life New Business Applications in the Agent Channel

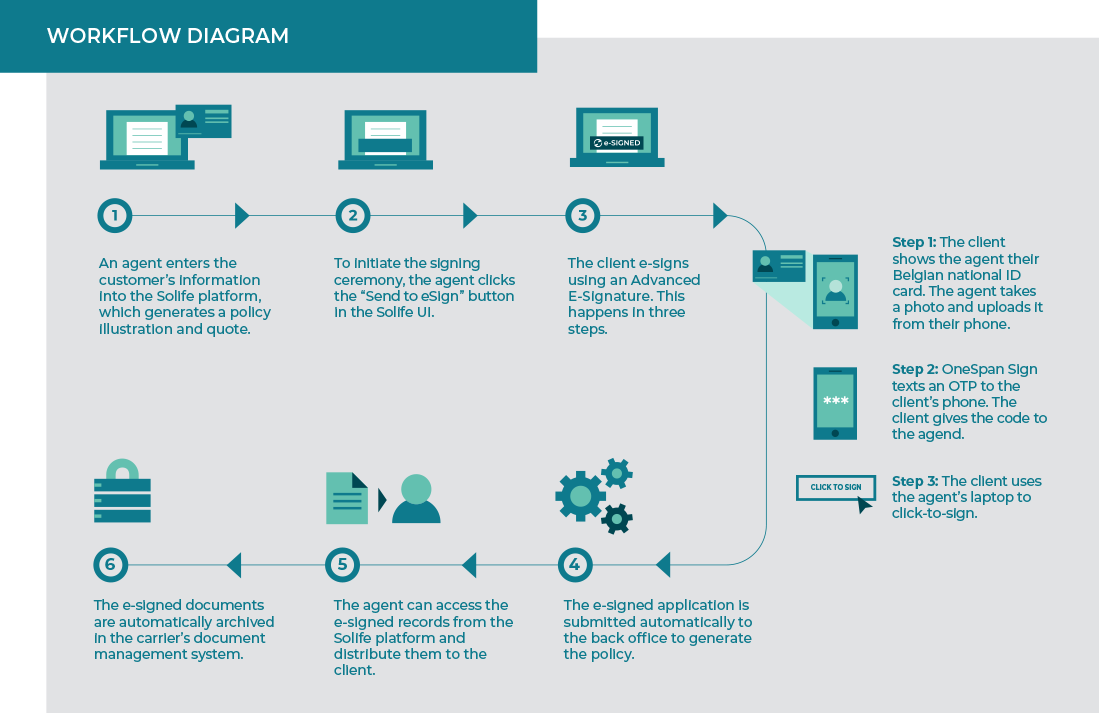

P&V started by digitizing life insurance applications. In June 2018, the carrier introduced e-signatures to their captive agents. “After one visit, the goal is to tell the client everything is ready, pending positive medical and financial acceptance,” says Rogier Dickmann.

Agents now process new business applications in one session, entirely from a laptop. The agent guides the client through the application interview in-person, just as before. However, they now have an end-to-end digital flow from the first contact with the client.

“It was truly the value-add that an e-signature solution brings when you are undergoing a digital transformation like we are doing here at P&V.

We started on the life side, with back-end and front-end platform replacement. E-Signature is a critical step in the process because it’s a legal requirement. You need a signature to have a valid application and the contract that follows.”

Integration and Deployment

In the insurance industry, e-signatures are implemented increasingly as an enterprise service that can be easily accessed by any line of business (LOB). This breaks down silos across the organization, saves developer time, accelerates rollout, and creates a consistent user experience.

A shared service provides a common integration approach for e-signature, using middleware. This is done by building an abstraction layer – essentially, the glue between enterprise systems and the e-signature service. The abstraction layer exposes standard e-signature functions to the lines of business and becomes the service point for all fully automated processes. P&V built a routing application that acts as the layer between the e-signature service and enterprise systems.

While the OneSpan Professional Services team provided API integration consulting, P&V did the integration, implementation, and deployment themselves over approximately six months.

The integration effort included:

The Routing Application

“It is important to understand how we designed and implemented the solution. The e-signature solution leverages a P&V-built routing application that connects the Solife policy administration system and life document repository with the OneSpan Sign service. Any other business platform or application that wants to use the service will do so by leveraging the routing application. So there is no direct interface between the business system and OneSpan Sign. That happens via our routing application,” Rogier Dickmann explains.

Development of the routing application took 1.5 FTE resources four months to deliver. The routing app makes it easier to bring on new business lines. If tomorrow a new department wants to use the e-sign service, they can connect to the P&V application and only need to add the necessary signature tags to their document templates – unless they have specific requirements not supported in the current build of the routing application.

“In that case, we would need to update our routing application. Because today it’s an MVP [minimal viable product]. But in the future, we will add more means of authentication, signing, etc. Then we will need to modify our application, but that is something that will benefit all the core systems that use the service. Then they have more options and choices to use the additional functionality. But if they want to use the features that are available today, it is very easy to bring on a new LOB.”

Integration with Core Systems

E-Signatures need to fit within a broader technology context, such as a policy admin, agency management, or document generation system. The first system to call e-signature APIs is the Solife policy administration system. For this integration, the P&V team had to foresee a button within the Solife interface from which to initiate the signing ceremony. Then the integration between that button and the P&V routing application had to be built.

Forms Preparation

In the P&V document management system, the team had to update their document templates with specific text tags so OneSpan Sign would recognize where to place the e-signature within the insurance application form.

In addition to the document tagging, P&V also did a pilot program and agent training. The team ran a pilot for three months with 25 agents. After six months in full production, the insurance company has 150 agents using the new system and several hundred customers have already e-signed their new business applications.

The Benefits

Digital tools and platforms increase efficiency, reducing time spent managing paperwork – an important advantage to busy agents. Agents now spend less time per signed document, and close business in fewer visits.

“With e-signature, it’s night and day in terms of a better process. It has improved the customer and agent experience. We’re also saving the cost of going back physically to get the application signed. The entire digital flow is a more efficient way of supporting clients.”

The feedback from agents has been very positive. Now they only need 10-15 minutes in a typical case to go through the New Business flow, e-signature included.

“Digital makes life a lot easier for clients and for agents. It saves a lot of time end-to-end. Not just because of e-signature, because of the full digital process. But e-signature does save a lot of time for the agent upfront. It’s really linked to the whole transformation really, and e-signature is an enabler of this,” says Rogier Dickmann.

As a OneSpan customer, we get fast resolution. Reaction time is really good. There’s a time difference, but if we send a question before 3:00 p.m. CET, next morning when we come into the office we always have an answer.

Conclusion

The insurance industry is rapidly adopting electronic signatures as part of larger automation and digital transformation initiatives. To digitize the insurance business, a number of technologies need to work together and e-signatures are the heart of that ecosystem. But without an enterprise vision, individual lines of business will source their own e-signature solutions.

If you want to prioritize a strategic enterprise approach and avoid redundant implementations, we can help you understand how to build once for reusability across all lines of business. Our methodology and best practices are built on more enterprise shared-services implementations than any other e-signature provider in the market. In fact, our insurance customers include some of the largest e-signature deployments in the world. The lessons learned and industry expertise acquired from working with industry leaders means we can offer the surest path to success for automated processing.

To learn more, visit OneSpan.com/sign.