4 trends changing the face of banking

We recently spoke to Ron Shevlin, Managing Director of FinTech Research at Cornerstone Advisors, and Forbes contributor, for a podcast on trends in digital banking and FinTech. In this article we round up the top trends discussed in the interview, along with additional insights from OneSpan experts on how these trends impact banks and financial institutions today.

Trend 1: Neobanks and FinTechs: Consumers aren’t looking for a new bank, they’re looking to accessorize

Consumers are looking to ‘accessorize’ their main account with digital-only providers who offer features their main account might not offer.

Ron explained that these additional features or capabilities could be personal financial management tools, higher interest rates on deposits, or better rates for loans. Consumers looking for these capabilities are looking to supplement their existing accounts with additional products. Ron calls this ‘accessorizing the checking account’. Challenger banks such as N26, Monzo, Revolut, Starling Bank in the UK, and Chime in the US, have all gained traction because they bring new capabilities to the table.

Ron: “We used to go out on a Friday and Saturday night, and we accessorized what we wore with jewelry and other things like that. And I think there's a real parallel here in the financial services world where consumers are accessorizing their main checking account with other products from digital-only banks and providers, neobanks or other FinTech companies, specifically for the individual features that those neobanks or FinTechs bring to the table and not necessarily as replacements.”

To get an understanding of how this accessorizing trend impacts banks and other financial institutions, we asked Bryn Saunders, Senior Product Marketing Manager at OneSpan, to explain how the rise of challenger banks and neobanks affects incumbent financial institutions.

Bryn: “A few years ago, a lot of the discussion was about whether incumbent banks would be replaced. We can now see that although many consumers have opened accounts with challenger banks, many do not use them as their primary bank. In the US, just 11% of consumers consider a digital bank their primary institution. That said, incumbents should not rest on their laurels. Challenger banks are catching up, and not just as secondary accounts. Between January and December 2020, the three largest incumbent banks in America, Bank of America, JP Morgan Chase and Wells Fargo, lost nearly 7% of the total share of primary bank customers. This should be a wake-up call to incumbents that consumers and increasingly becoming comfortable with these new, user-friendly apps in their everyday lives.”

Trend 2: Digitizing Account Opening: Overcoming account abandonment is all in the design

On the topic of account opening, the podcast discusses both the impact of challenger banks on the account opening process, as well as the findings of the 2021 Cornerstone Advisors report Reducing Friction in Online Account Opening with Digital Identity Verification. The report draws on research conducted with consumers and financial services executives on:

- Digital account opening capabilities across deposit and lending products

- Consumer engagement with digital account opening and their reasons for abandoning applications

- Financial institutions’ adoption of digital identity verification technology

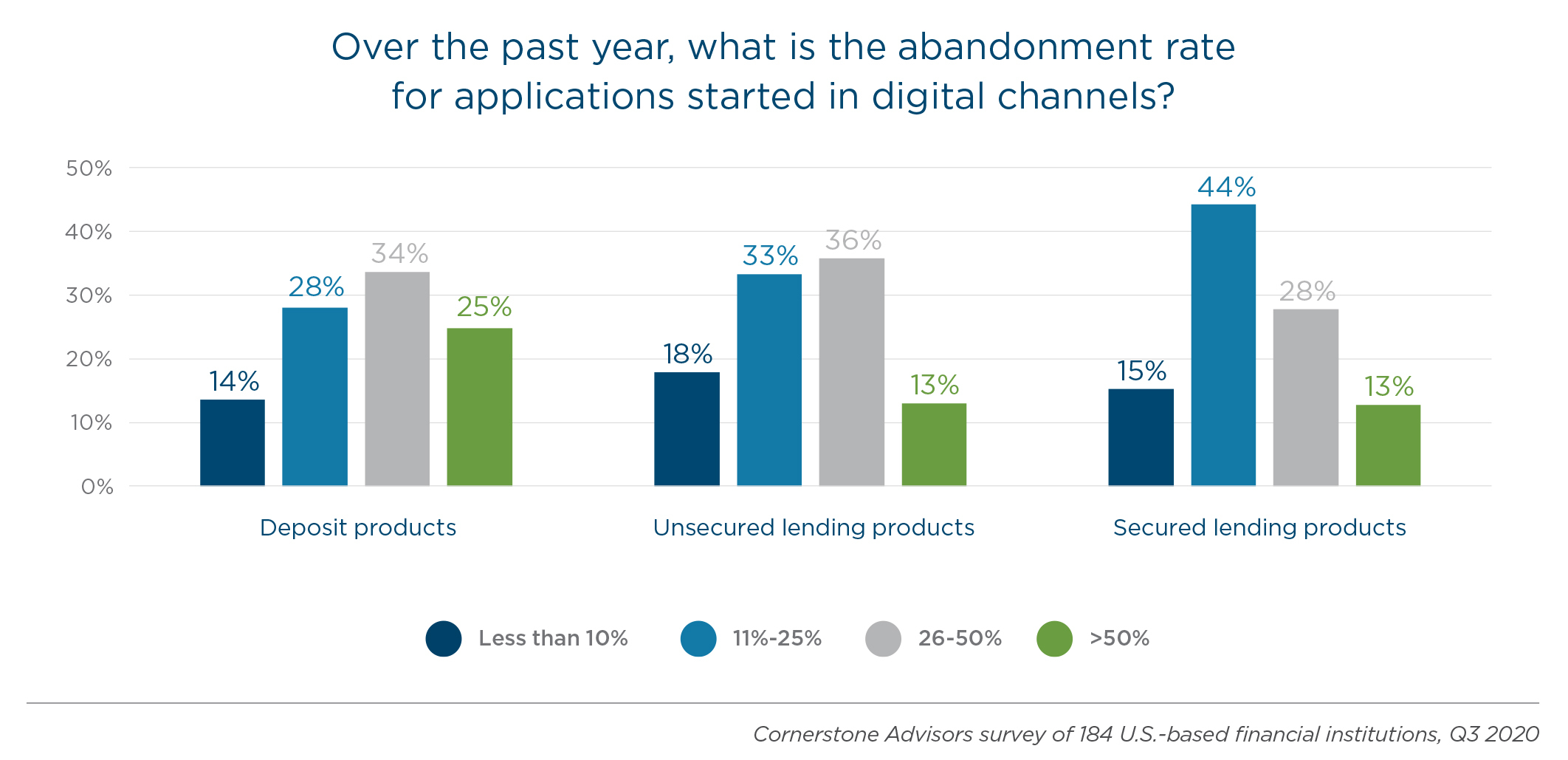

One of the stand-out findings of the report was that financial institutions are experiencing a high rate of digital account opening abandonment across deposit and lending products. Among the institutions that offer digital account opening for deposit products, one-third saw between 26% and 50% of applications abandoned while a quarter had more than half of applications abandoned.

For many of the financial institutions surveyed, abandonment was caused by friction during the identity verification stage, such as inability to answer relevant knowledge-based authentication (KBA) questions. On overcoming this challenge, Ron placed an emphasis on the importance of designing a digital process that requests identity verification at the right time for the applicant.

Ron: “Part of the design process from a digital account opening perspective needs to think about at what point do we really need to do identity verification. If somebody is really not intending to hit the submit button and just looking for information, forcing them to provide the identity verification requirements is probably going to drive them away really fast […] So from a design perspective, where identity verification happens and how it happens becomes a very important design consideration.”

On how challengers are leading the pack in digital account opening design, Ron warned legacy bank that digital-only neobanks have set the bar for digital account opening process, especially on a mobile device. The use of digital identity verification methods such as facial biometrics and automated ID document verification (ID scanning from a mobile device) are re-aligning consumer expectations for online account opening.

Ron: “Because the neobanks or challenger banks are pretty much digital-only, they've really started from scratch in building the account opening experience and have really set the bar for digital account opening for the banks. And now that there's real competition between the challenger banks and the traditional or legacy banks, it's placed a greater emphasis on that initial experience for the traditional banks to catch up and meet the bar that the digital banks have established.“

Trend 3: Bank Branches: Consumers don’t want a relationship with a machine, but they don’t want a relationship with bricks either

Deposit accounts per branch have declined from an average of 44 per month in 2012 to 23 per month in 2019 (Cornerstone, 2020). The pandemic also contributed to a drastic reduction in branch traffic in 2020. As branches start to open across the world, Ron had some insights whether branch use will continue to decline, and what factors of the branch are most important to the bank’s customers.

Ron: “There's no question that for many people the branch is important, and not because it's brick and mortar, but because it offers them access to people. I think this is one of the big misunderstood points in the world of banking.

“In the early 2000s, one of the leading bank publications asked a bank executive in the US why his bank wasn't investing in the online channel. And he said, ‘Because nobody wants a relationship with a machine.’ And he's probably right, but what he really misunderstood there was that ‘Look, people don't want a relationship with a brick either, they want relationship with people.’"

Many financial institutions are engaging with technology vendors to invest in ways to interact and transact with humans without being face-to-face in the same building. One example of such an innovation the adoption of e-signing so that customer service reps can enable customers to access finance and loans without the need for a face to face meeting.

When the global health crisis shuttered offices and branches overnight, Peoples United Bank did just this. With 400 retail locations across the northeastern United States now closed, the bank needed to enable remote business wherever paper was involved, without losing focus on providing a top-of-the‑line customer experience. E-signatures also enabled them to quickly respond to new opportunities like the SBA’s Paycheck Protection Program (PPP) in order to distribute emergency small business loans.

Ron: “The convenience for most consumers to get advice is not necessarily going down to the branch and talking to somebody, but having access to everything that's available digitally, and having that digitally assisted or human-assisted digital transaction. Going forward this idea of human plus digital becomes very important.”

Trend 4: Embedded Finance: Most financial institutions are going to have to get really good at APIs…and stopping mobile attacks

The next three to five years will undoubtedly bring many changes in the way businesses and individuals interact with their financial services providers. As FinTech becomes more ubiquitous and big retail firms such as Walmart continue to expand the services of their apps, FinTech looks to be going mainstream. Chat bots, the use of artificial intelligence and machine learning, and connected devices, are all changing the way we operate on a day-to-day basis. For financial institutions, staying ahead of the curve is essential.

On what banks can do to prepare for the future, Ron advised that the industry is moving towards a state of ‘embedded finance’, whereby consumers will acquire financial services from financial services providers or banks, but not through traditional mechanisms. Instead, they might acquire services through a third-party app or service that they use regularly. Ron uses the example of Uber drivers, who might acquire loans through Uber’s app, with the actual service provided by an embedded financial services provider.

Ron: “In effect, what embedded finance means for banks is that it's just a new distribution channel. Instead of selling through their own website or selling through their own mobile app, they'll have to sell through Amazon, through Google, through Etsy, through Square…. And banks are going to have to get really good and fast from a digital perspective.”

This system of embedded finance will require financial services to safely integrate their services with third-party apps while still protecting their services from fraud.

Ron: “Financial institutions are going to have to get really good at APIs - utilizing them, writing them, managing them and understanding the business impact, because the interconnectedness of financial services firms with other non-financial services firms and consumers is going to grow exponentially.”

In June 2020, the FBI issued a warning anticipating an increase in the number of attacks on mobile bank customers due to soaring use of banking applications. That warning came to fruition in December 2020 with a massive mobile fraud scheme known as the evil emulator farm attack. By using a network of emulators (technology used by developers to test and interact with apps via a simulation of a mobile device), hackers were able to spoof thousands of compromised user devices and originate fraudulent banking transactions. They were successful in defrauding millions of dollars from bank account holders in the US and across Europe in a matter of days.

In a recent article, John Gunn, CMO at OneSpan, offered further insights on the fraud implications of embedded finance for financial institutions:

John: “This [embedded finance] will be a blessing for consumers as they gain instant access to additional high-value services and more companies compete for their interest. At the same time, it will drive a necessity that countless additional companies provide banking-level security for their customers who are now conducting financial transactions with them. Hackers follow the money and the expansion of financial services into all areas of our lives will provide a myriad of new targets for criminals.”

Looking Ahead: How Financial Institutions Can Prepare for Accessorizing, Digital Identity Verification, Super-Apps, and Embedded Finance

The trends discussed by Ron Shevlin all have a direct impact on financial institutions today. As banks and financial institutions continue to adapt their digital banking strategy to meet the needs of a rapidly changing society (as well as rapidly advancing attacks), we asked Bryn Saunders for his advice on how financial institutions can best prepare themselves for what lies ahead:

Bryn: “Financial institutions should stop viewing identity verification, user authentication, and fraud detection as separate entities. They all pertain to the customer experience and mitigating risk, so it will become an imperative to identify where these technologies can be deployed across various use cases. At the end of the day, I think it all comes down to the customer, and how you’re reducing friction for them while also mitigating fraud. That’s a win-win scenario.”