eSignature for dealer management systems: Rethinking the status quo

OneSpan Sign developers: How to secure API calls with OAuth 2.0

Update on Salesloft data breach impacting OneSpan

Why lending platforms are rethinking eSignature tools in 2025

How multi-channel notifications are redefining agreement turnaround

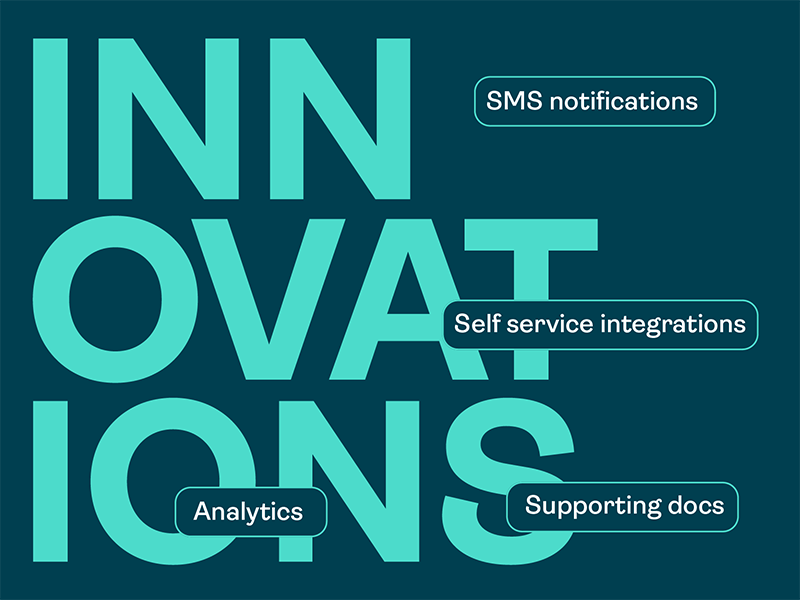

Digital agreement innovation: OneSpan H2 2025 enhancements

Central Bank of UAE boosts consumer protection against fraud