OneSpan Sign: Delivering digital trust in a changing world

In the world of digital transactions, electronic signatures have become indispensable. As companies continue to make the shift from paper-based workflows to digital ecosystems, the need for secure, compliant, and user-friendly eSignature solutions is more pressing than ever.

One company that has carved out a leadership space in this domain is OneSpan. In this review, we’ll explore OneSpan’s unique take on solving the eSignature challenge, offering robust electronic signature solutions that not only accelerate digital transformation for clients but also pave the way to enable secure, efficient, and trust-based customer relationships.

The evolution of eSignatures

eSignatures have evolved from simply being an efficiency tool to becoming crucial for enhancing customer experience and operational productivity, especially amid the shift towards digital-first and mobile-first business strategies. Initially designed to streamline laborious paper-based processes, eSignatures have transformed into vital assets for customer-facing roles and organizations. This shift gained momentum due to the COVID-19 pandemic, making digital signatures not just convenient but essential for conducting business in today’s world.

Superior user experience

OneSpan’s primary differentiator is its commitment to providing a secure and user-friendly experience designed to drive adoption of electronic signatures. OneSpan’s approach is fundamentally different in how it engages with the user. While you often might not see their name explicitly, OneSpan powers the eSignature capabilities of giants like Standard Chartered and RBC, fully integrated and white-labeled within these trusted platforms. This private-labeling strategy allows client brands to stay front and center during the entire e-signing process and aligns with the company’s philosophy that adoption is best achieved when users trust the entity they’re interacting with.

Complete electronic signature platform

OneSpan Sign extends far beyond the act of capturing an electronic signature, offering a complete solution suite including secure electronic signature, identity verification, strong authentication, secure collaboration and video conferencing including remote online notarization and immutable storage. It comes with a rich out-of-the-box user interface, eliminating the need for businesses to develop their own, thereby saving both time and money. In addition, there’s a Sender GUI that enables manual, sender-driven transaction management, offering an alternative to traditional system-generated transactions. Not only does OneSpan offer its product as a subscription service to enterprises, they also cater to SMB customers in a scalable and cost-effective manner.

Ease of integration accelerates digital transformation

OneSpan Sign seamlessly integrates with clients’ current systems, enabling a quick transition to digital workflows no matter the business size. With an open REST API and fully supported SDKs, integration is quick and efficient.

OneSpan Sign comes with pre-built connectors for popular applications such as Salesforce, Workday, and Microsoft Dynamics 365. This means minimal coding or IT resources are required to integrate digital signing into clients’ daily business applications and allowing users to sign documents through a variety of channels, including mobile devices, online portals, and even call centers.

Architecture & deployment: Flexibility at its core

One of the standout features of OneSpan Sign is its flexible architecture, which is divided into two main components. The OneSpan Platform serves as the product’s core, handling transactional and business logic. Then there is the OneSpan Sign Application, the user-facing part of the product that can be accessed via a graphical user interface (GUI), APIs, SDKs, or connectors. This two-tiered architecture ensures a streamlined user experience and offers the flexibility needed to adapt to different organizational requirements.

Scalable and versatile enterprise-grade solution

OneSpan prides itself on being an enterprise-grade solution. In an industry filled with niche vendors and segmented point products, OneSpan’s comprehensive capabilities set it apart.

A notable feature of OneSpan is its ability to scale applications to meet the varying needs of different transaction types. Whether it’s a mortgage application requiring a 30-year commitment or a simple in-store loan at IKEA, OneSpan’s platform adjusts the level of assurance required. This adaptability makes the platform not just user-friendly but also incredibly versatile. According to Alexander Kiesswetter, CIO at Raiffeisen: “We wanted to innovate and simplify the customer experience. With OneSpan, we were able to do that.”

Additionally, the global footprint of OneSpan allows the company to serve different markets, accommodating varying legal frameworks for e-signatures. OneSpan serves 60 of the top 100 global banks, which speaks volumes about its capabilities and solutions quality.

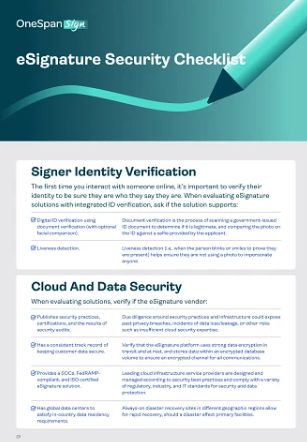

Strong identity assurance

In the wake of the increased remote interactions due to the pandemic, the challenge of establishing identity and trust online became critical. OneSpan addresses this by incorporating identity and trust functionalities directly into its product. This focus on verification ensures that businesses can trust that they are interacting with who they claim to be, providing varied levels of assurance based on the type of transaction. OneSpan Sign employs a plethora of identity, ranging from government ID and biometric verification to SMS one-time passcodes and knowledge-based authentication. This assures that signers are who they claim to be, bolstering the integrity of each transaction.

Security: A commitment to trust

Security is a cornerstone of OneSpan Sign’s offering. The platform ensures the integrity of the documents being signed as well as the transactional workflow. Each document is protected by digital signature encryption and a tamper-evident seal, providing robust digital evidence to confirm that a document has not been altered during the signing process. This is in addition to comprehensive audit trails, to ensure that your e-documents are not just secure but also compliant with laws like UETA, ESIGN, and eIDAS. This level of evidence is particularly crucial in highly regulated industries, such as banking, where security and compliance is not an option but a necessity.

The platform undergoes regular updates to counteract vulnerabilities and supports a wide array of platforms, operating systems, and browsers without compromising on security standards.

Compliance

Another critical dimension is compliance. From GDPR in Europe to CCPA in California, each jurisdiction presents its unique set of regulations affecting identity, data, signatures, and much more. A large part of digital signature adoption is driven by industries with high levels of regulatory or compliance requirements, such as banking. Whether it’s a consent form from a customer or maintaining records for legal reasons, OneSpan aims to serve these diverse compliance needs effectively.

The platform maintains comprehensive audit trails to facilitate easy verification and legal compliance. OneSpan Sign is compliant with various regulations like ESIGN, UETA, and eIDAS, and has also obtained certifications like FedRAMP, SOC 3 Type II, ISO/IEC 27001 and HIPAA.

The future of digital signatures

The future of digital signatures is poised for transformation, driven by advances in artificial intelligence (AI), blockchain technology, and changing perceptions of what constitutes consent and agreements. OneSpan predicts that AI will be pivotal for fraud detection and user productivity, enhancing security while also making form-filling more contextually relevant. Blockchain will also play an important role, providing immutable, transparent digital storage of not just documents but a range of digital artifacts, like PDFs and smart contracts throughout the lifespan of the agreement

This evolutionary trajectory indicates that digital signatures are set to become an integral part of a more complex, secure, and user-friendly digital experience.

The concept of ‘signing’ is expected to extend beyond traditional documents to include various mediums like web pages and voice messages. By investing in these emerging technologies and redefining what constitutes an ‘agreement,’ companies like OneSpan are leading the charge in shaping a future where the eSignature landscape is far more dynamic than it is today.

Our verdict

OneSpan Sign stands out as a versatile, secure, and highly integrable electronic signature solution. Its emphasis on strong identity verification, advanced security protocols, and a user-friendly experience make it a favored choice for businesses in highly regulated industries.

In an industry filled with competitors, OneSpan distinguishes itself through a secure, private-labeled, and user-friendly experience designed to drive adoption. Its focus on security, compliance, identity verification, and scalability makes it an enterprise-grade solution capable of serving varied and complex needs. This capability has earned OneSpan the trust of the world’s most demanding financial institutions, solidifying the company’s status as a leader in the eSignature space.

This article was first published in Cybersecurity Insidersin October 2023.

*Editor’s note: As mentioned above, OneSpan Sign is compliant with various regulations like ESIGN, UETA, and eIDAS – as well as HIPAA. In addition, OneSpan has also obtained certifications like SOC 2 Type II, ISO/IEC 27001, 27017, and 27018, and has several FedRAMP ATOs.