Fast, secure, digital: Rethinking digital forms and agreements

Every digital customer interaction provides an organization with the opportunity to deliver an impactful experience and build trust. Yet the digital experience customers have online often doesn’t meet expectations. There’s little surprise, then, that an unremarkable digital experience often yields incomplete or abandoned digital agreements.

Customers are demanding a better, more dynamic, and more modern experience, even with a complex, highly regulated agreement transaction. At the same time, organizations want high completion rates and satisfied customers without overlooking security, specifically, having the necessary safeguards in place to prevent fraud and protect both the customer and the organization.

So where is the disconnect?

Let’s examine the challenges of digital agreements today and explore how to more effectively balance ease of use with security to drive transaction completions.

Today’s challenges with digital agreements

We can all relate: We walk into an appointment and are handed a clipboard to fill out a form you likely already filled out online. So, you begrudgingly fill out the form and wait while your information is often manually entered into the system.

Already feeling like a waste of time, it becomes more frustrating when you come back for a follow-up and you’re asked to complete the same process all over again.

For high-stakes digital transactions, like those within financial services or insurance, the disconnect between the expectations of a modern digital experience and the actual experience has a direct business impact.

There are six primary challenges associated with digital data capture capabilities that can lead to an unproductive business outcome when you rely heavily on static PDFs and forms:

- No pre-fill ability. When you ask customers, especially repeat customers, to key in the same information repeatedly, they question their value to you. Auto-fill capabilities, combined with ease-of-use, is why the Amazon experience is so highly praised. Data capture for digital agreement transactions should include pulling information from additional sources in real-time to reduce the number of manual prompts it takes to complete the digital transaction.

- No conditional logic. Critical information can’t be validated in real-time. This is also paired with the static form being non-dynamic and non-intuitive. If there is information missing or if something is inputted incorrectly, the user needs to rekey information completely, and there’s significant room for error when it comes to manual data capture. Non-dynamic forms may also need to be printed or emailed, presenting another obstacle and more time to complete the transaction.

- No insertion for clarification. With static forms, there’s little to no engagement with the user to ensure they accurately answer the questions.

- Long time to completion. As we alluded to in our example above, there’s often a time lapse between initiation and submission of the final, accurate form. Today, customers expect digital transactions to take minutes, not days or weeks.

- Not mobile responsive. Many digital forms are often just static PDFs that are not mobile-friendly or editable, making them difficult to read or update when accessed from a mobile device.

- Channel and signature limitations. Customers expect digital transactions to be efficient and accurate across channels, and they expect those transactions to be secure across channel shifts, as well. If you start a form on your computer, for example, you will want that form to recognize you already started it when you reopen it on your mobile device. Customers want a uniform experience that includes the ability to e-sign, regardless of the channel.

Each of these challenges highlights the need for today’s organizations to offer a fast, secure, and modern digital experience while also having the right level of security in place to establish trust.

Rethinking digital agreement forms

According to McKinsey, organizations that digitize the customer experience see a 15-20% increase in customer satisfaction and 20% higher conversion rates.

The easier an organization makes the customer-facing (i.e. front-end) experience—and the more they can leverage the information they already have to do that—the more positive that experience is. This then translates directly into loyalty and trust. Worth noting is that if the digital experience isn’t effectively managed, organizations can lose customers; 47% of consumers have stopped doing business with a company after losing trust in their digital security.

The backend of the digital agreement contains all the information necessary to ensure correct execution. This means ensuring the transaction is secure and meets regulatory standards to protect both the consumer and the organization.

There are three things we recommend organizations consider specific to security when rethinking their digital agreement forms to inspire trust and greater completion rates:

- 1. Ensure they know it’s you. One of our customers experienced a 23% increase in new policies in the first 30 days when they switched to a fully white-labeled experience. Their customers were more receptive to digital interactions when the organization’s name was present vs. the eSignature vendor’s name.

- 2. Identity verification processes. Ensure you have identity verification built into the digital agreement to increase confidence that the user is who they say they are. Worth noting is that 33% of fraud is often detected during customer onboarding, a 10% increase over last year. As a result, many consumers are happy to take extra steps to ensure they can protect themselves from fraud. 64% of consumers said they feel safer using a digital financial product when they’re required to provide identity verification information, such as taking a picture of their driver’s license.

- 3. Encryption. Enable encryption to ensure the signing of the data and intent captured through these digital conversations and agreements is protected for the foreseeable future. This extends to ensuring both consumer and organization are protected, as well.

Introducing OneSpan Smart Forms

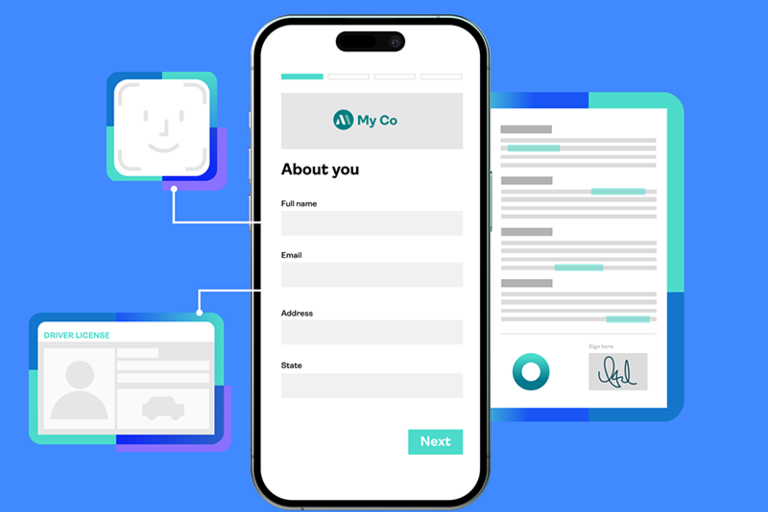

Today’s modern customer expects more than a static digital form; they want a dynamic digital experience that makes the entire process fast, secure, and easy.

With Smart Forms, you can enhance your data capture capabilities to improve the customer experience and securely pass along the data to the eSignature service to complete the digital agreement transaction.

Smart Forms allows organizations to minimize known friction points that cause dissatisfaction and abandonment. By using known information about the customer, and a dynamic interactive communication method that leverages an intelligent, interview-style digital form, the customer experience is easy and personalized.

Smart Forms leverages technology that helps organizations optimize agreement signing processes and workflows, especially for organizations in regulated industries with significant compliance requirements, such as insurance, financial services, and healthcare.

Consider these benefits for organizations that leverage Smart Forms in highly regulated industries:

- Insurance: New policy applications or claims processes can be completed in 15 minutes vs 45 days. This extends to a variety of insurance types, as well, from auto to life insurance.

- Financial services: A new account can be opened in eight minutes on a mobile device and funding provided to the customer in minutes or days.

- Healthcare: Consent forms can be completed in seconds before a clinic or hospital visit, making the patient experience much better. No more filling out forms with a pen and paper on a clipboard in the waiting room.

Digital transformation is driving the customer experience

Organizations that simplify the data capture and signing experience establish trust, ensuring the customer knows you’re protecting them while also providing a better overall experience. In addition, organizations that leverage a modern approach to data capture also see faster time-to-revenue for account openings, loan origination, insurance policy applications, and many other use cases.