How CURE Auto Insurance digitized with OneSpan Sign for Guidewire InsuranceNow

Top auto insurers know they must evolve to fit the flexible needs of the drivers they insure. Because more than half (53%) of first-time auto insurance buyers initiate provider relationships through online channels, it’s essential that digital auto insurance processes are seamless and user-friendly.

CURE Auto Insurance aimed to create 100% digital new policy applications and renewals to meet the needs and expectations of policyholders. That meant CURE needed an embedded electronic signature solution that would allow their customers to sign policies anytime, anywhere.

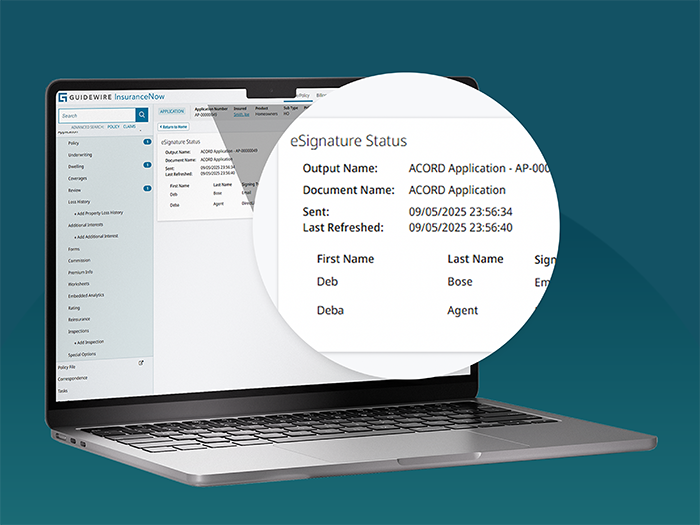

OneSpan Sign’s eSignature capability embedded in the Guidewire InsuranceNow platform offered an easy, low/no code way for CURE to integrate electronic signatures on their own to fully digitize policy processes.

Digital auto insurance with eSignatures

Because eSignatures are essential to digital transformation in insurance, CURE decided to implement them based on three factors:

- Customer convenience. With eSignatures, customers don’t have to wait for paper agreements to arrive in the mail or worry about mailing them back. Instead, they can sign required documents at any hour of any day, making the process quick and convenient.

- Protection for customers and meeting regulatory requirements. In some states, regulations require customers to sign multiple insurance-related documents, such as disclosure forms and those related to premium payments. eSignatures provide a secure format for customers to complete these required signatures.

- Greater operational efficiency and ROI. With eSignature for insurance, agencies are able to eliminate printing for signature and mailing, manual verification of document data, and imaging and scanning for storage. They can also reduce NIGO rates and errors, the number of fields to complete the application, and policy completion time.

Douglas Benalan, Chief Information Officer at CURE, said, “Transform everything to digital, that's my philosophy. [...] Here at CURE, we have digital as our top priority and are working to transform as many aspects as we can into digital technology. We’re marching towards removing any process that is repeated manually or requires mailing. Even in claims, we moved away from the physical check to our digital print.”

The ROI of OneSpan Sign for Guidewire InsuranceNow

Enabling eSignatures in the Guidewire InsuranceNow platform helped CURE become more competitive in the auto insurance space. The agency achieved the following results:

- Greater customer retention. By offering customers the option to complete a policy in their channel of preference — whether online or via an agent — CURE is better able to meet their needs, improving overall retention rates.

- Higher completion rates. With eSignatures, customers can sign their policies anytime, anywhere, reducing signature friction and increasing CURE’s completion rates.

- Increased protection through digital evidence and an audit trail. Because the entire policy transaction happens digitally, there is an electronic audit trail. When customer disputes arise, CURE can quickly demonstrate their transparency and that they captured all the necessary approvals and data, reducing legal costs and potential revenue loss.

- Improved efficiency and reduced costs. By eliminating manual steps, including paper mailing and handling, CURE reduced costs and improved overall efficiencies by 22-25%.

Go digital with eSignature and document automation for insurance

If your organization is looking to go digital with eSignatures, learn more about improving the insurance customer experience with Guidewire InsuranceNow and OneSpan Sign. See the Guidewire website or contact us at OneSpan to learn more about our integrated eSignature solution.