The electronic signature software enterprises love

OneSpan Sign delivers a scalable eSignature solution designed to make document signing secure, compliant, and more efficient than ever.

Trusted by:

Growth. Every business is looking for it.

Equip your team to accelerate revenue with OneSpan Sign.

A top insurer shortened time-to-revenue with mobile eSignatures & smart forms.

A leading auto manufacturer streamlined the financing process for consumers.

Bank of Montreal representatives spend less time on paper and more time with clients.

Standard Chartered transformed CX at scale, across 40 use cases globally.

Discover OneSpan Sign

Learn how OneSpan’s electronic signature software is designed for enterprise workflows with features like white-labeling, user authentication, and detailed audit trails. It combines customer experience with best-in-class security, keeping transactions on-brand and easing compliance across the organization.

Achieve higher completion rates for signature requests

Put your brand front and center. White-label branding boosts user adoption and completion rates by up to 23%.

OneSpan Sign enables you to fully white-label the UI, pop-ups, and email notifications to create a trusted experience. This way, signers aren’t surprised by a brand they don’t know or were not expecting when signing electronic documents.

Deploy eSignature services enterprise-wide

Most eSignature solutions support a limited set of use cases. OneSpan Sign is different. We enable you to digitize more use cases for electronic documents across the organization in a cost-efficient and standardized way using our market-leading APIs, integrations, and web and mobile app.

This lowers total cost of ownership (TCO), ensures a consistent customer experience, and facilitates compliance.

Enterprise benefits at a cost-effective price

OneSpan offers transparent pricing and high-quality customer service, giving you the most value for your money.

Our pricing is transparent and fair, with standard features included at no extra charge.

Plus, you’ll have peace of mind, knowing we are here to help you achieve higher digital document completion rates and faster ROI.

Stay safe with bank-grade security standards

We know security. Let us safeguard your organization from financial losses and protect your brand reputation with a solution designed to thwart identity fraud, tampering, phishing attacks, and more.

From authentication and white labeling to identity verification with liveness detection, OneSpan Sign provides robust protection.

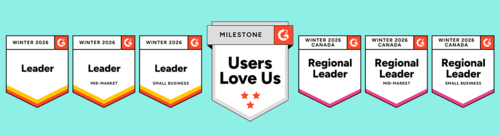

G2 USER SATISFACTION RATINGS REPORT

We're the eSignature software that enterprises love

When it comes to ease of use, quality of support, and custom branding, we lead the way.

More than an electronic signature

OneSpan offers a full digital agreements solution to meet your needs now and into the future.

OneSpan Smart Forms

OneSpan Smart Forms is a low-code digital forms automation solution that turns traditional, static paper forms into digital, two-way conversations.

OneSpan Identity Verification

Document verification and facial comparison help businesses validate the identity of an applicant and prove that the validated identity is genuinely the individual they are interacting with.

OneSpan Notary

OneSpan Notary delivers live eSignature, secure videoconferencing, ID proofing, collaboration features, ability to upload the eNotary Seal, eJournaling, and more.

FAQ for OneSpan Sign electronic signatures

An electronic signature (eSignature) is a secure, digital way for someone to approve or sign a document online and is a key element to legally binding digital agreements. Electronic signature software is used to sign everything from offer letters and sales contracts to rental agreements, liability waivers and financial documents, so you can handle business anywhere, anytime. Because they capture intent and are protected by security and compliance controls, they’re also legally enforceable across most business and personal transactions worldwide. Learn more about how eSignatures work.

Yes, electronic signature is legally binding and enforceable in countries that have enacted electronic signature laws.

Electronic signatures created using our solution comply with both the U.S. ESIGN Act and UETA. OneSpan Sign electronic signature also comply with Regulation No 910/2014 on Electronic Identification and Trust Services Regulation (eIDAS) in the European Union. Other countries have established similar laws as well. Visit our eSignature legality guide to learn more.

Yes. Security is always top-of-mind at OneSpan.

OneSpan Sign follows a variety of regulatory, industry, and IT standards for security and data protection. In addition, OneSpan Sign meets the compliance standards set by ISO/IEC 27001, ISO/IEC 27017, ISO/IEC 27018, SOC2 Type 2, FedRAMP, HIPAA, Skyhigh Enterprise-Ready, GDPR, and more. Please visit the OneSpan Sign Trust Center for additional information.

Though related concepts, digital signatures and electronic signatures are different. An electronic signature is a legal concept. Its captures a person’s intent to be legally bound to an agreement or contract.

However, a digital signature refers to encryption/decryption technology within an electronic signature. Based on public-key cryptography, digital signatures secure signed documents and allow one to verify the authenticity of a signed record.

In short, a digital signature cannot capture a person’s intent to sign a document. When used with an electronic signature application, digital signature technology secures the eSigned data.

Creating and electronic signature with OneSpan Sign is easy. You could use click, type or draw action to sign at specified location. As an account owner, you can easily create and save a reusable handwritten signature to your account profile. OneSpan Sign leverages digital signature technology to create secure electronic signatures. We also support digital certificates stored on the user’s system, government-issued smart cards (e.g., CAC/PIV, national eIDs, etc.), and hardware tokens to authenticate the identity of users. Learn more.

OneSpan Sign supports a range of pre-built and custom eSignature integrations with CRM applications like Salesforce and Microsoft Dynamics 365, HRIS systems such as Workday and Greenhouse, productivity and storage tools like Google Workspace and Microsoft 365 (SharePoint, OneDrive), as well as fully embedded solutions. Learn more about OneSpan Sign’s eSignature integrations.

All you need to send documents is a web browser and a subscription to the OneSpan Sign Professional Plan. Upload your documents, add recipients, select signature blocks and fields, select a signer authentication method, then click “Send to Sign” to distribute your document for signing. Each recipient will receive an email invitation to sign the document.

You can electronically sign a document quickly and easily with OneSpan Sign.

- As a signer, you will receive an email request for your signature. Click the link to access the document from your email.

- You will be directed to the document which requires your signature.

- To electronically sign the document, simply click on the signature box. Once you are done signing the documents, click the confirm button.

OneSpan Sign supports the following document formats:

- PDF / Adobe PDF (.pdf)

- Microsoft Word (.doc, .docx)

- Open Document Text (.odt)

- Text (.txt)

- Rich Text Format (.rtf)

- Google Workspace

We also support any document that can be printed from any Windows-based application like Word, Excel, and PowerPoint with the OneSpan Sign Print Driver.

OneSpan offers plans that provide enterprise-scale solutions with greater flexibility and scalability for small business and enterprise customers. We provide the greatest price per value, so customers get more for their money. This includes excellent customer service, built-in security features, and workflow integrations to minimize a brand’s tech stack. Learn more.

OneSpan Sign is available to try for free for 30 days. Learn more.

Your eSignature solution should be transparent in pricing and able to grow with you as a partner, whether you’re a small business or a large enterprise. Depending on your company’s industry, you’ll likely benefit from eSignature fitting into your business’s daily workflow. Learn more.

Switch to a better solution

Compare your current eSignature tool against the modern and secure enterprise-grade solution.