Easy Integration

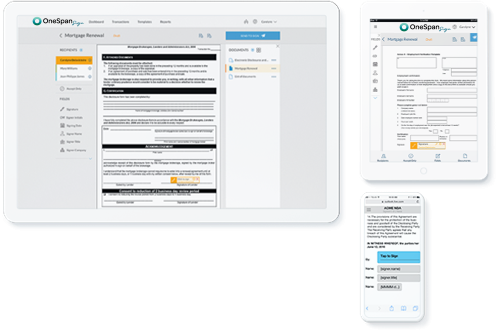

Add e-signing capabilities to your website, mobile app, and core systems using our powerful REST API and SDKs

Our powerful REST-based open API and SDKs come packed with everything you need to ensure rapid development and deployment. This includes support for common programming languages (including Java, .NET, APEX, Android, and iOS), an out of the box UI, sample code, complete documentation, an active developer community, and much more.

User Experience

OneSpan Sign is optimized for desktop and mobile signing right ’out of the box’, and enables you to quickly configure the solution for your needs. You can also fully customize the workflows and UX to create a unique customer experience. That includes white-labeling at no extra charge.

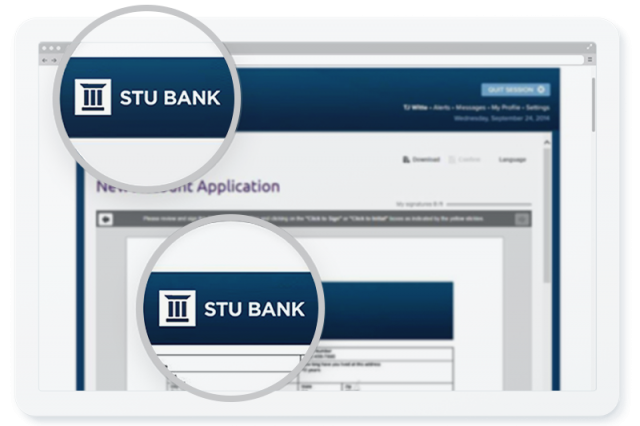

White-Labeled

OneSpan Sign’s brand doesn’t appear in any of the interfaces or email notifications. Your brand remains in the spotlight to ensure the most seamless user experience. This helps drive high adoption and transaction complete rates.

Not White-Labeled

With some e-signature vendors, their brand is part of the user experience creating confusion and risk of customers dropping off. What's more, emails sent from the vendor's servers can expose your organization to risks such as phishing.

Deploying eSignatures as a shared service

In this report, five leading banks and insurers ranging in size from 5,000 – 270,000 employees share their best practices for deploying eSignature as an enterprise service.

Download nowAdvanced Security

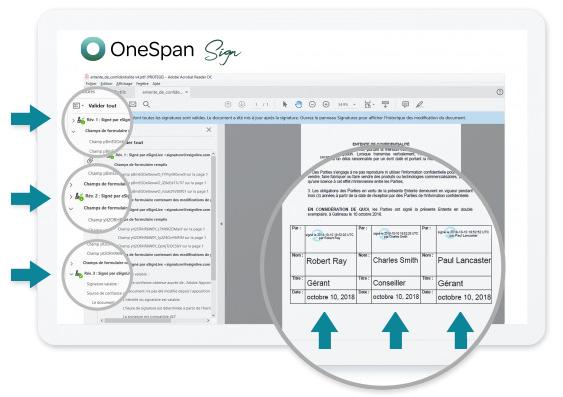

Secure your documents and each person’s signature using military-grade, digital signature technology

OneSpan Sign guarantees document integrity by applying a digital signature and tamper seal after each person has signed, and then automatically detecting if a change is made in between signers. And unlike other providers, OneSpan Sign embeds the audit trail directly in the document, enabling you to instantly verify it with just one click.

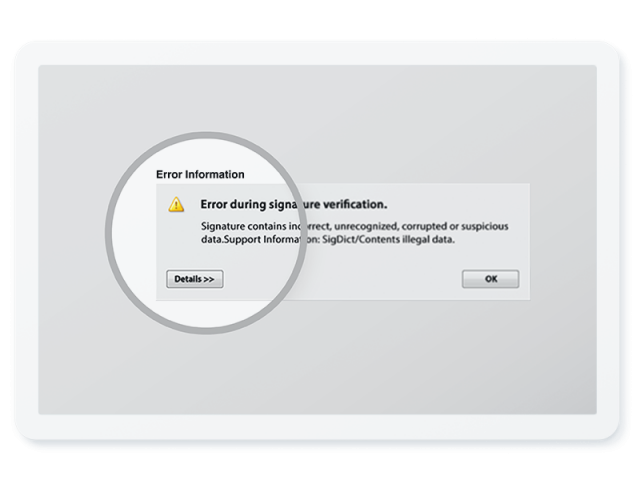

Digital Signature for EACH & EVERY Signer

OneSpan Sign secures each person’s signature in the document using digital signature technology so that if a change is made in between signers, their signature is visibly invalidated. This deters fraud and provides a more reliable audit trail. The audit trail is directly embedded in the document, resulting in a single file that’s easier to verify and manage.

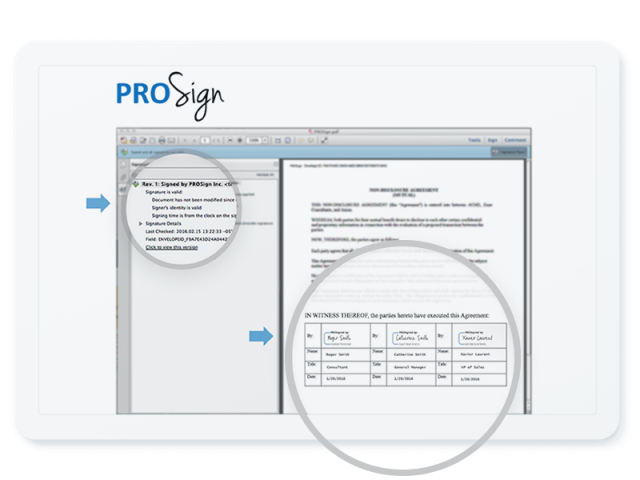

Digital Signature for ALL Signers

Some other e-signature solutions only apply a tamper seal wrapper at the end of the signing process, enabling the document’s content to be modified without detection in between signers. What’s more, their audit trail is only available as a separate file, forcing you to store two files and making it longer to verify.

Built on leading infrastructure services from Amazon, IBM and Microsoft to ensure high application security

Keep your company and customer data safe using Advanced Encryption Standard (AES) 256-bit encryption. OneSpan Sign complies with ISO/IEC 27001, ISO/IEC 27017, ISO/IEC 27018, SOC 2 Type II, HIPAA, FedRAMP and other stringent industry security and privacy requirements. See the summary of the auditor’s report at the Trust Center.

Compliance & Legal

Prove your compliance and deflect legal disputes with our audit trail

Captures identity verification, authentication, and e-signature events of the entire agreement process in a single, unified audit trail. Our audit trail provides a more complete picture of the transaction with strong identity assurance to demonstrate compliance for remote processes.

Flexible Implementation

Code once. Deploy anywhere. OneSpan Sign provides the most flexible deployment options and global data centers to ensure compliance with your company’s risk protocols and in-country data residency requirements. Start with one deployment method, then easily switch methods in the event your IT policies change. You can even combine public and private clouds and on-premise deployments.

Implement electronic signatures as a shared service across your divisions and global operations for a quicker time-to-market. OneSpan Sign provides the most scalable platform and integration framework, enabling you to easily re-use the same code across different lines of business, use cases, channels and geographies.

OneSpan Sign is hosted on redundant and resilient cloud infrastructures, that enables us to deliver 99.99% uptime. That’s why 15 out of the top 20 banks in North America trust OneSpan Sign’s performance and availability for their high-volume, customer transactions.

Cost

Get transparent pricing with no nickel and diming, no hidden fees, and no surprise price increases

Unlike other electronic signature providers, you won’t see an astronomical price increase at the end of your contract. We work closely with you to review your consumption needs and help you scale your model in the most cost-effective manner. What’s more, if your needs and volume change before your contract is up, we’ll re-assess the terms so that you maintain a cost-effective solution – today and tomorrow.

Digital Transformation in Personal Banking (BMO) Celent Case Study

This case study delivers an analyst's view into the BMO's enterprise-wide, shared services approach to e-signature. Packed with metrics and best practices, this Celent report offers unique insights for IT, business, and compliance stakeholders.

Read the Case Study