Trusted by Industry Leaders

Business Challenge

Organizations continue to replace paper with digital documents and business processes. This drives a need to digitize the delivery and execution of consumer-facing agreements, but automating high-volume, B2C processes is complex and compliance driven.

“Regulated industries and demanding B2C environments are [OneSpan Sign]’s sweet spots.”

Forrester Vendor Landscape, E-Signature

Success Stories

Insurance

Auto Insurance Policies

This direct-to-consumer insurer saw 23% higher forms completions after replacing DocuSign.

Insurance

Life Insurance Applications

OneSpan Sign enables the fifth largest insurer in Belgium and its agents to finalize life insurance applications in as little as 15 minutes.

Commerical Banking

SMB Lending

Early results with BDC were outstanding. The new process reduced the number of fields to complete from 208 to 30 to submit a loan application.

Energy/Utilities

Sales Contracting

The energy retailer saved 75% of what they would have paid for DocuSign’s renewal price.

Blog

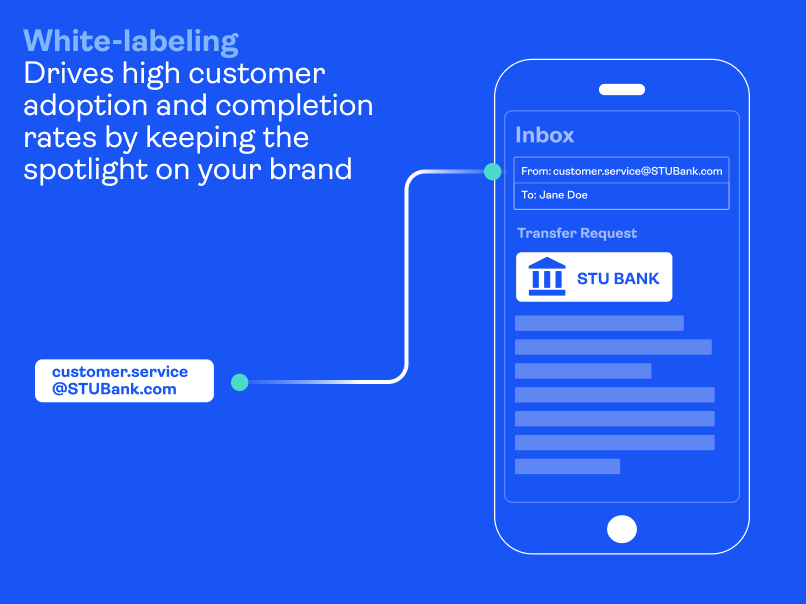

How white-labeling helps prevent phishing attacks

Learn how to protect your brand, build trust with signers, and achieve high completion rates.

Read nowWhy OneSpan Sign?

Superior Experience

Bring automation to your agreement workflows and deliver optimal experiences to your customers and employees – across channels and devices

Global Solution

An enterprise-grade solution that scales across geographies with support for Simple, Advanced, and Qualified E-Signatures, multiple languages, and data centers around the world

Strong Electronic Evidence

Vendor-independent audit trails that help you deliver legally binding, admissible, and enforceable digital agreements

Secure Agreements

Bank-grade cloud security, digital signature encryption that guarantees the integrity of your agreements, and strong authentication options