How HR departments should think about hiring and remote onboarding

4 HR digital transformation trends in 2025

Winning in a changing wealth management industry

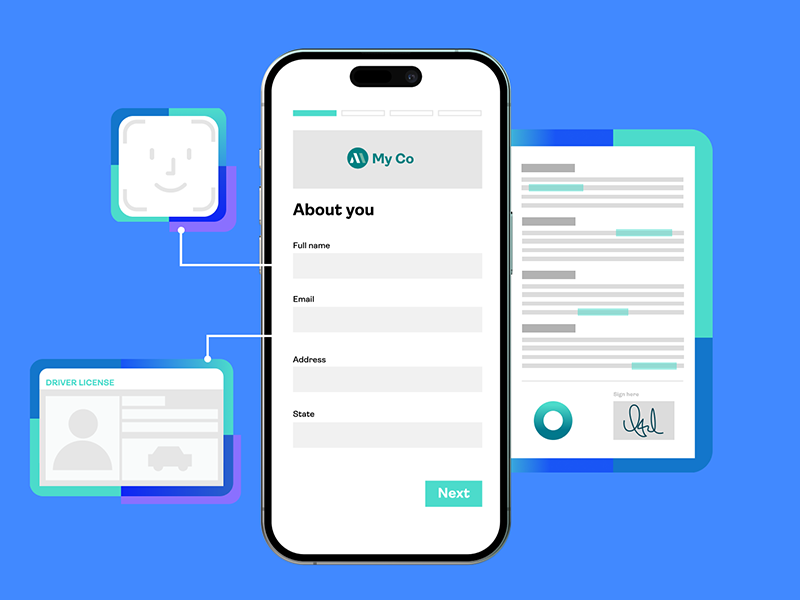

Digital agreement and security solutions bring trust and efficiency to virtual transactions

BACC Solutions: Leveraging the benefits of seamless eSignature and IDV integration in real estate

How to initiate the signing process from Google Drive

6 OneSpan Smart Forms differentiators: Electronic forms built for enterprise workflows